This week we have several very important economic reports coming out. These top tier reports will give us key data on future indicators regarding factories, jobs, and consumer confidence.

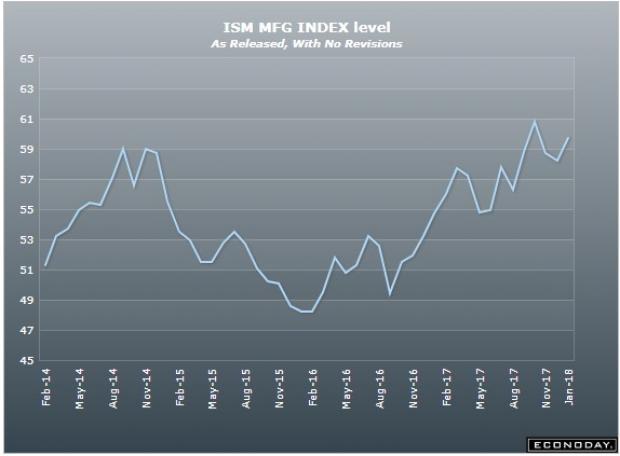

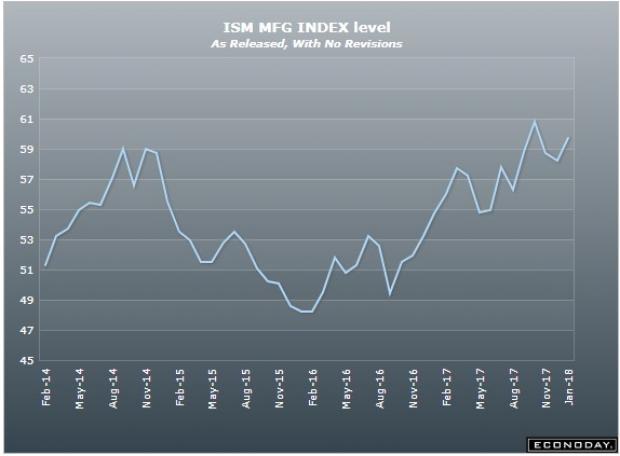

The biggest report is coming out Thursday; the ISM Manufacturing Index. This forward looking report has a long track record of accurately gauging the direction of production, employment, new orders, inventories, prices, imports, and exports.

Source: Bloomberg.com

As you can see in the chart above, the ISM index was hurting for a long period of time, with a sustained dip starting in the end of 2014 and lasting all the way through 2016. The index began to bounce back in early 2017. But since February of 2017 the index has been getting stronger with energy, a weakening dollar, and the expansion of the global economy lifting the index.

Current expectations are for the index to dip just slightly from a reading of 59.3 to 58.7. While this would be a pull back, it would still show strength across all categories. Last month, new orders hit a 14 year high, with a reading of 69.4.Another strong report from the ISM would be an overall positive for the industrial, factory, manufacturing, and production segments of the economy.

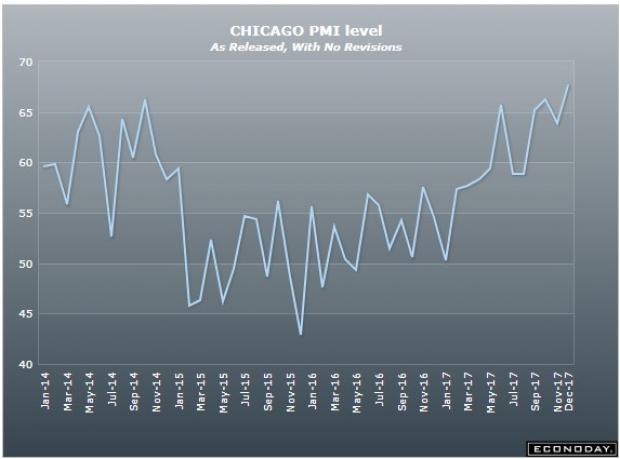

On Wednesday, we will get a preview of the ISM report as the Chicago Purchasing Managers Index, or PMI is released. The Chicago PMI is the most important of the regional manufacturing reports, as it is seen as being a strong representation of the overall economy. This report has a long history of being highly correlated with the national ISM manufacturing index.

Source: Bloomberg.com

You can see the correlation between the two manufacturing reports, with the Chicago PMI falling in the beginning of 2014, and staying at low levels till the early parts of 2017.

Last month the Chicago PMI showed extraordinarily strong growth with a reading of 67.8, and Wednesday’s report is expected to come in just below that, at a reading of 64. This would still be very positive news for the manufacturing sector, as last month’s reading was near its historic high.

Leave A Comment