As you’re surely aware, keeping up with the CFTC positioning data is mandatory these days.

It’s kind of like Trump’s Twitter feed. You don’t want to watch it, but you have to if you hope to have a clue about what’s going on.

Last month we saw the massive spec Treasury short hit 4 standard deviations – so, a multi-sigma event. And speaking of “deviations,” we saw a massive discrepancy between specs and real money in 5Y futs. “The real money always prevails,” they’ll tell you.

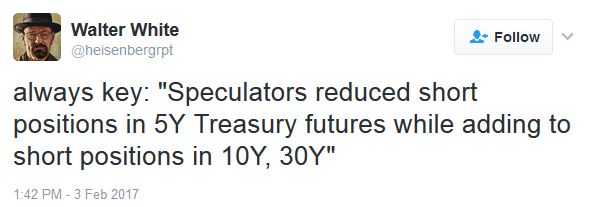

Well the latest data is out (as usual, up to date through Tuesday) and guess what? The Treasury short is still way on out there at 3 standard deviations despite a trimming of 5Y short positions.

Here’s Deutsche Bank:

Speculators eased their short positions in Treasury futures for the third straight week by $1.1 billion to $79.1 billion in ten-year cash equivalents. Having said that, spec positioning is still heavy at -8% of the duration-adjusted open interest and at 3 standard deviations of the range in last three years. Specs cut 38K contracts and 34K contracts from their net shorts in FV and TU futures, respectively, and also bought back 10K contracts in WN futures. However, they sold 56K contracts in TY futures over the week and net shorts remained close to its recent historic high.

For those interested, here’s the more granular breakdown:

(Charts: Deutsche Bank)

On the FX side of things, the breakdown is as follows (via Bloomberg):

- Reduced net JPY short by 13,995 contracts to 33,376

- Reduced net EUR short by 14,907 contracts to 76,559

- Lowered net GBP short by 10,557 contracts to 50,420

- Increased net AUD long by 13,336 contracts to 24,941

- Boosted net NZD long by 4,863 contracts to 21,473

- Added to net CAD long by 3,457 contracts to 9,612

- Reduced net CHF short by 1,565 contracts to 11,283

- Raised net MXN short by 1,293 contracts to 66,225

- Cut net RUB long by 525 contracts to 13,001

Leave A Comment