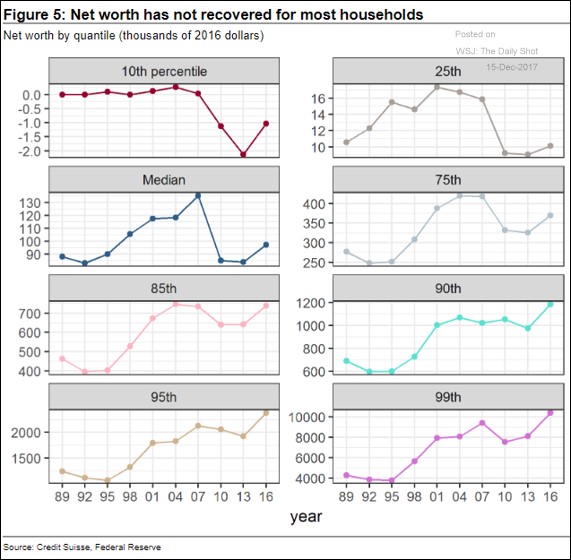

The Poor Have A Negative Net Worth

In a previous article we discussed how populism could rise in 2017. If you’re career is going well, you might be detached from the plight of some in the lower class. The charts below help you understand their recent woes. It shows the changes in net worth in each quintile. As you can see, those in the 25th percentile have barely seen any gains since the financial crisis. This is because they don’t own stocks and they haven’t seen much real wage growth. Some in this group lost their house during the financial crisis and never recovered. Their net worth is only $10,000. Median households have recovered slightly from the downturn, but are nowhere near what they were at in 2007. Since the median income of households is $59,039, this means they have less than 2 years of income in savings and investments. Even the 75th percentile hasn’t recovered fully from the great recession. Only those in the 85th percentile or higher have recovered from the recession. I think this is great evidence for why the 2008 recession will stand as the worst recession for decades. A house is the most valuable asset people have. It’s almost impossible for those with median incomes or below to recover financially after getting kicked out of their house.

Since this recovery has been based on increasing financial assets, specifically in the stock market, if the next recession hurts stocks the most and real assets the least, it might mean middle and lower class people won’t get hit too hard. The best comparison to this scenario is the 2001 recession. Even though tech stocks crashed, the rich did well. The 2001 recession didn’t have much of an impact on any households’ net worth because it was shallow.

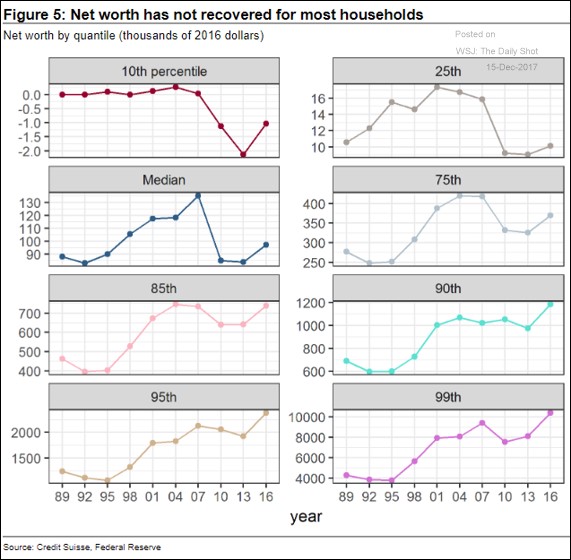

Lowering Lending Standards

To provide a counterpoint to my statement that the next recession won’t be as bad for the middle class and the working poor as the previous one, we have the chart below which shows the lending standards for FHA loans have been declining. As you can see, the FICO score for loans supported by the government, which allow for 3.5% down payments, have been declining in the past 2 years. Both the median and average FICO score have fallen. A FICO score between 680 and 699 is considered good credit. A FICO score between 620 and 679 is reasonable credit. That means these loans are falling from good credit to reasonable credit. The lower the credit score, the high default rates on houses in the next recession.

Leave A Comment