Investors on election night: “serenity now.”

Investors today: “zzzzzz.”

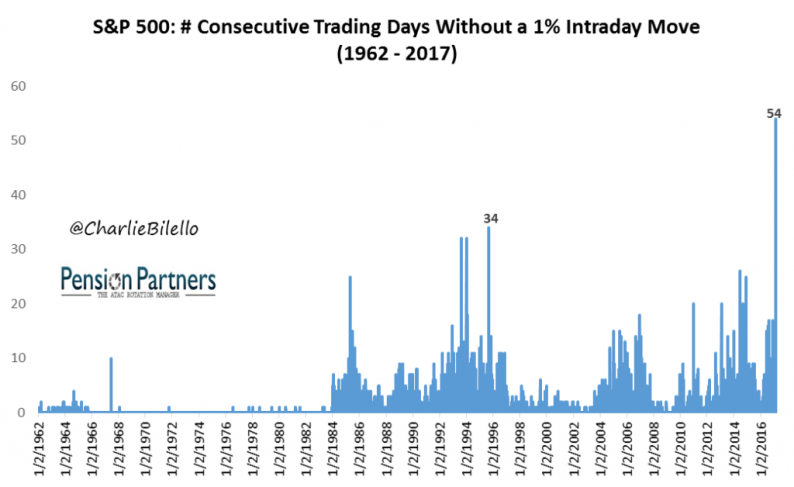

Since mid-December, we have witnessed the most peaceful market in history. The S&P 500 has now gone 54 consecutive trading days without a 1% intraday move (high to low as a %), trouncing the prior record of 34 straight days from back in 1995.

When I post these stats on twitter, the most common response is negative, invoking “the calm before the storm” and other bearish omens. “Be afraid,” they write, “be very afraid.”

Which begs the question: is there any evidence that such periods of calm tend to proceed an imminent top?

Not exactly. Following long streaks with little intraday volatility in the past, the S&P 500 has been higher one year later in every single instance. None of the prior examples occurred days/weeks before a major top.

After the calm period in April-May of 1985, the S&P 500 would gain 117% over the following five years. After the calm period in November-December of 1992 the S&P 500 would rally 168% over the following five years. In December 2010, we saw a calm period that was followed by an 80% advance over the next five years.

To be sure, the examples are not all positive. After the low volatility period in December 2006, the S&P would suffer negative 3-year and 5-year forward returns. But there was no imminent top, with the ultimate peak not occurring until October 2007.

What will happen from here? I don’t know.

What happened in the past only tells us what has happened in the past. This is not 1985, 1992-95, 2005-2006, 2010, 2013-14, or 2016. This is 2017 and this time will be different because every time is different.

The best we can say about unusually peaceful markets is that there doesn’t seem to be any generic rule for when that peace will come to an end. It could end tomorrow, it could end next month, or it could end in a few years.

Leave A Comment