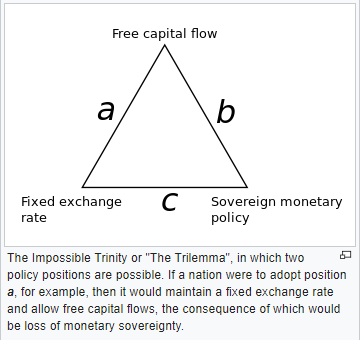

The Mundellian trilemma says policy makers can control only two of the three main variables in global finance, but not all three at the same time.

“…it is not feasible to have at the same time a fixed exchange rate, full capital mobility, and monetary policy independence. Only two of the three may co-exist (according to the Mundel-Fleming logic),” writes Helene Ray, of the London School of Business, International Channels of Transmission of Monetary Policy and the Mundellian Trilemma.

That’s the theory. Now take a look at China’s situation for application of the theory. Chinese policy makers seem to be stuck in a tight policy box—the alternatives available aren’t very appealing.

The dynamics of the trilemma for China can be seen in the chart below…

The chart above compares the benchmark 2-year Chinese interest rate (red); to the 2-year United States interest rate (black); to the Chinese currency priced in US dollars (green).

Note:

1. The 2-year yield spread between China and the United States is narrowing as the Fed continues to hike the Fed Funds rate, while the Chinese 2-year yield is falling as China attempts to stimulate growth (so far it isn’t working).

2. As the 2-year yield spread narrows between the China and the US, it pushes the value of the Chinese yuan lower; i.e. CNY/USD is moving lower as the spread (red line minus the black line) narrows. Hot money is moving out of China and into the US.

China is facing slowing growth, rising unemployment, and the possibility of a major acceleration in capital flight (as we saw back in 2016).

So, China’s policy choices seem to be these:

1. Raise interest rates and protect the currency (including capital controls) in an effort to avert a capital run. This means China loses control over sovereign monetary policy which calls for lower rates to stimulate growth (add more debt). Unemployment rises under this policy choice and that means China’s efforts to rebalance its economy and shift more resources to the household sector is stymied once again.

Leave A Comment