If you repeat a myth often enough, it will eventually be believed to be the truth.

“Stop worrying about the market and just buy and hold stocks.”

Think about this for a moment. If it were true, then:

Because “buying and holding” stocks is a “myth.”

Wall Street is a business. A very big business which generates huge profits by creating products and selling it to their consumers – you. Just how big? Here are the sales and net income for some of the largest purveyors of investment products:

There is nothing wrong with this, of course. It is simply “the business.”

It is just important to understand exactly which side of the transaction everyone is on. When you sell your home, there is you, the buyer and Realtor. It is clearly understood that when the transaction is completed the Realtor is going to be paid a commission for their services.

In the financial world, the relationship isn’t quite as clear. Wall Street needs its customers to “sell” product to, which makes it less profitable to tell “you” to “sell” when they need you to “buy the shares they are selling for the institutional clients.”

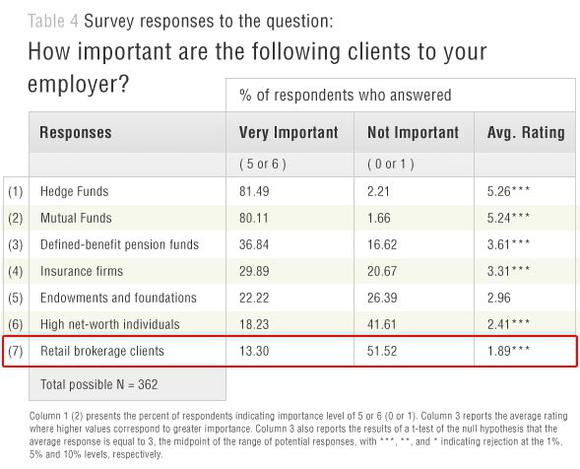

Don’t believe me? Here is a survey that was conducted on Wall Street firms previously.

“You” ranked “dead last” in importance.

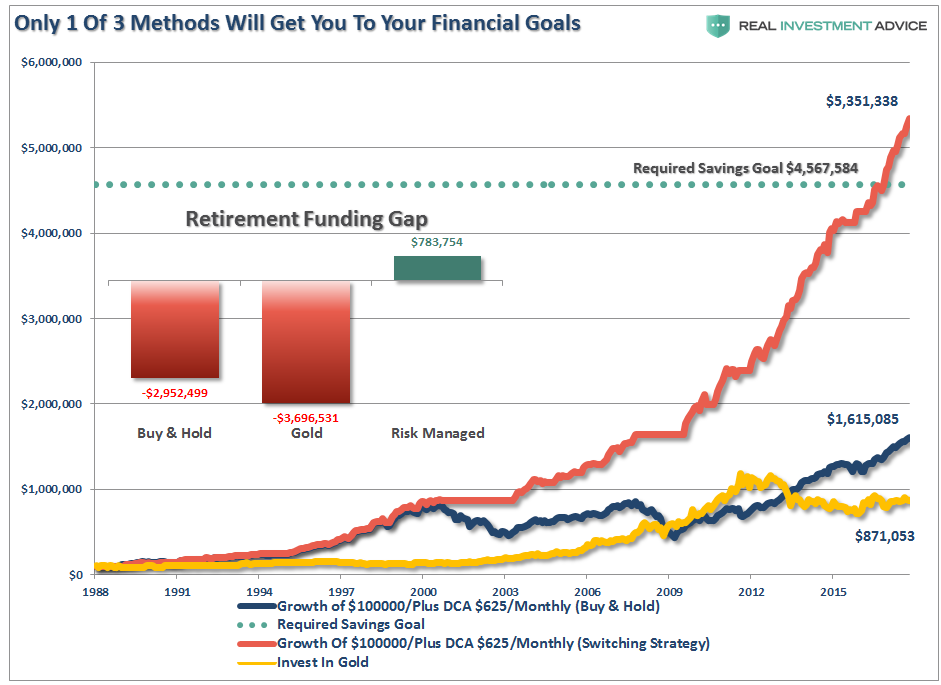

Most importantly, as discussed previously, the math of “buy and hold” won’t get you to your financial goals either. (Yes, you will make money given a long enough time horizon, but you won’t reach your inflation-adjusted retirement goals.)

“But Lance, the market has historically returned 10% annually. Right?”

Leave A Comment