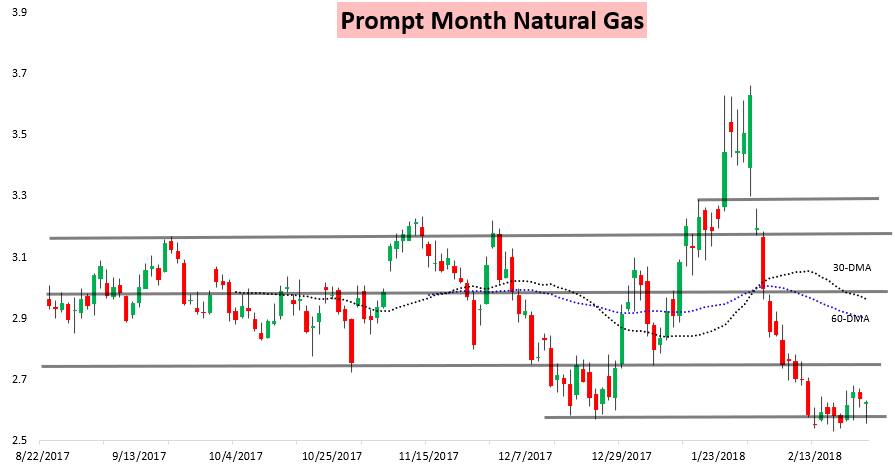

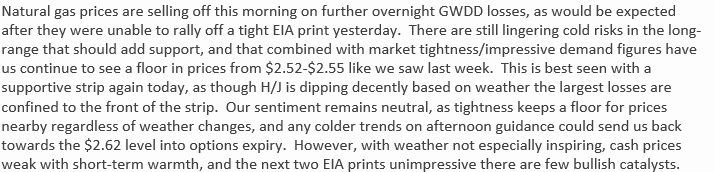

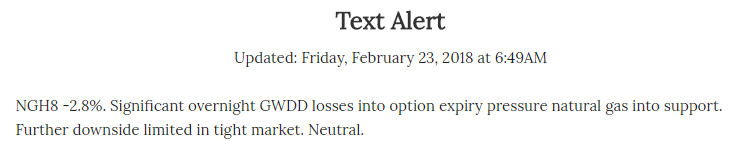

Natural gas traders awoke to a market that was trading significantly lower as overnight weather model guidance decreased demand significantly. When we sent out our Morning Text Alert to subscribers prices were down a full 2.8%, though we noted downside from there was limited.

Afternoon model guidance turned a bit more supportive, however, and prices rallied into option expiry, settling down just slightly on the day but not nearly as much as they could’ve.

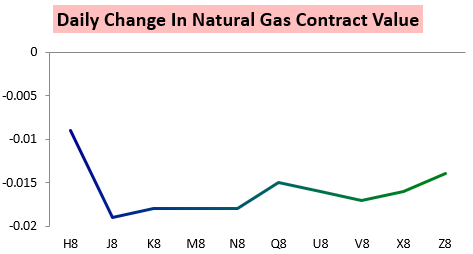

The March natural gas contract lagged significantly through much of the day, but rallied the most into settle, actually leading the day at the end.

Prices settled right around the $2.62 level that we had alerted subscribers to watch for in our Morning Update. At that point, natural gas prices were still down 2.3% on the day.

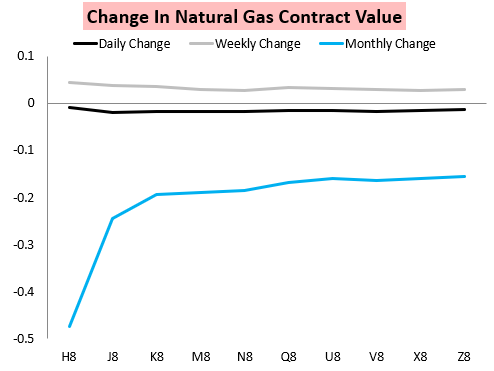

Thanks to the rally into the settle, the entire strip settled up on the week, with the largest gains at the front of the strip. Over the last month, though, we have still seen significant losses as we erased any winter premium.

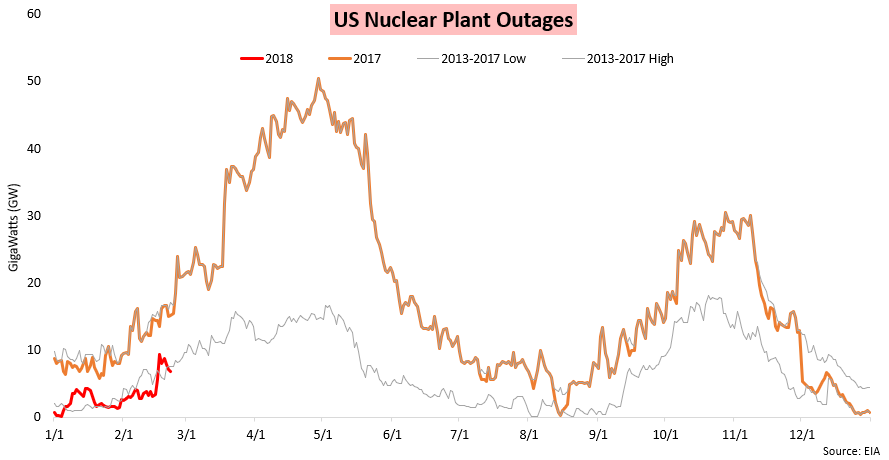

Natural gas prices the last two weeks have found a hard floor, and as we explained to subscribers we see that coming from recent market tightness. This tightness has come despite limited nuclear plant outages, which are down significantly year-over-year.

This was a focus in our intraday Note today to subscribers explaining why yet again we expected support to hold.

The weekly gain did confirm our weekly slightly bullish sentiment from Tuesday as well.

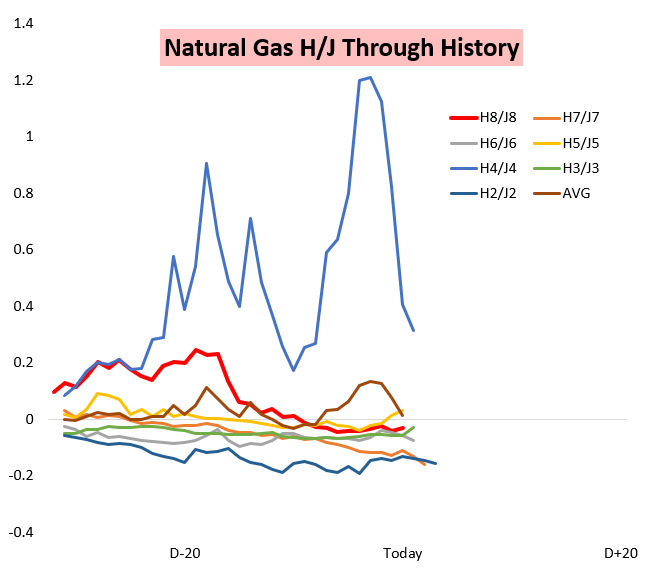

Next week will bring further complications with the March contract expiry, however. Headed into the Monday expiry we note that the H/J spread is above all but two of the last 6 years, with history providing only mixed signals as to how the spread tends to act into expiry.

Of course, stockpiles below the 5-year average will continue to play a role, and though we project the difference to average closing over the next four weeks it does not look too significantly.

Leave A Comment