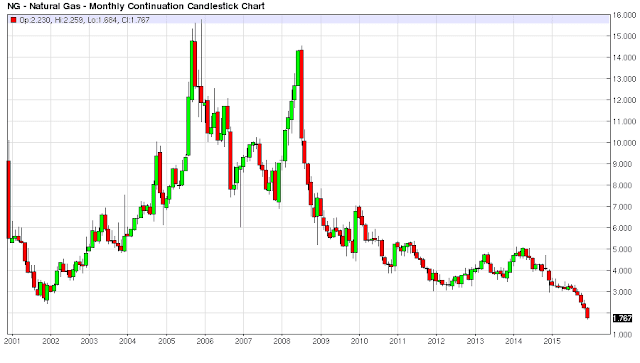

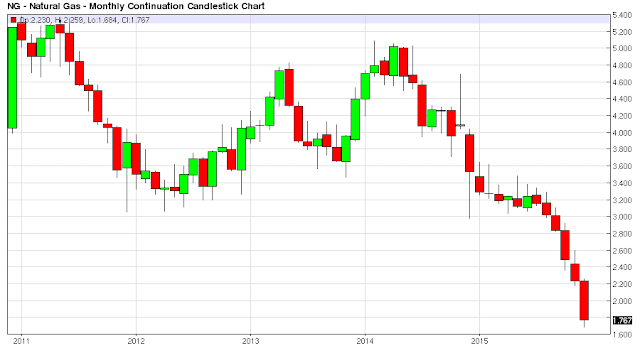

A lot of bearishness has been priced into the natural gas market due to many factors including robust production, bulging inventories, and mild weather on average across the country. Natural gas in the futures market reached a low of $1.68 MMBtu for Henry Hub on the January contract this past week. Natural gas closed trading on Friday at around $1.77 MMBtu.

These prices for natural gas are the lowest in 15 years and the questions that accompany such lows are the following: How low can prices go, do these low prices create a buying opportunity, what kind of timeframe is involved, and what is the best strategy for capitalizing on a rebound in natural gas prices.

How Low

In regard to how low natural gas can go, back in 2012 traders and analysts were talking about sub $1 MMBtu natural gas based on the fact that the derivative product`s markets related to natural gas production were actually booming for the specialty gases. Hence a producer was incentivized to produce natural gas below cost because the margins were so high for the specialty gases associated with producing natural gas in the drilling process. In 2012 natural gas for the front month contract in Henry Hub futures dipped briefly below $2 MMBtu around the time when traders were discussing sub $1 natural gas.

Given the fact that even the best traders and market analysts have no idea the exact low point for any market, let us just use this $1 MMBtu price for the worst case scenario for how low natural gas prices can go. I firmly believe in the rationality of financial markets in the longer term, and from this follows the old trading axiom that there is no cure for low prices like low prices. I don`t think there is that much more money to be made from the short side of the natural gas market over the same three year time frame.

Buying Opportunity

Therefore I view the current price of natural gas as a buying opportunity over a three year time horizon. I realize that I cannot predict the bottom in the market, and I am not going to try and be perfect regarding timing the turn in the market. However, I do predict given the decline in oil and gas drilling rigs, the economics of producing below longer term costs, and the fact that markets often lead the fundamentals, that this represents a buying opportunity in natural gas. I am basically buying when everyone else and their grandma is selling the natural gas market. I am sure corporations, wildcatters and trading firms are all making business decisions based upon these low natural gas prices, and they are not from the bullish side of the equation. I want to be on the other side of this trade given my three year time horizon.

Leave A Comment