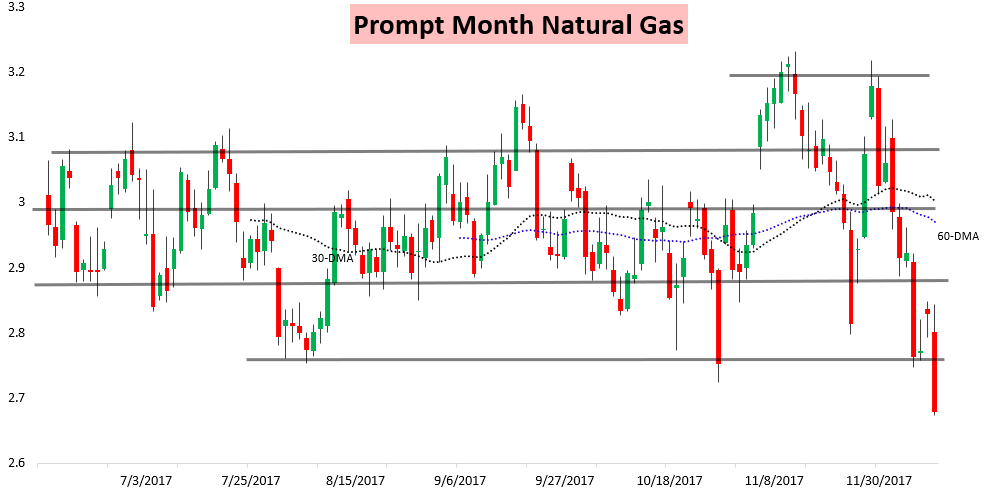

Natural gas prices are continuing to search for a bottom. After a modest gap up and stable prices yesterday, sellers returned with a vengeance today to pull prices down over 5% on the day.

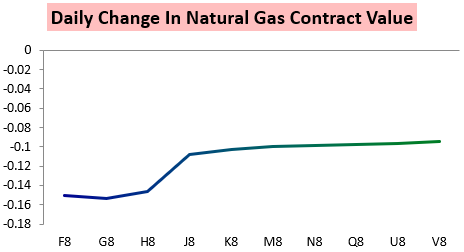

Yet again we saw the rally as being primarily balance-driven, as the entire natural strip got hit hard.

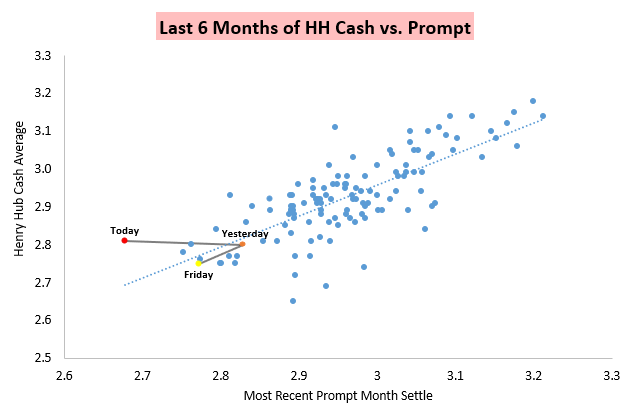

With short-term cold, the front of the natural gas curve was unable to decline much more than further back contracts, with cash prices mostly stable on the day.

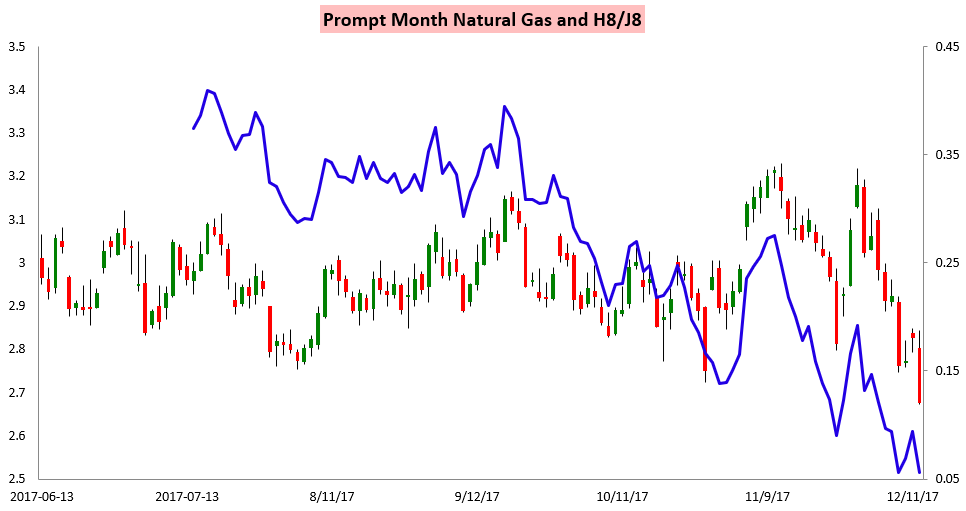

Despite the massive decline in prices along the natural gas strip, the March/April (H/J) spread settled at the same level it did last Thursday, even with the January contract a full leg lower.

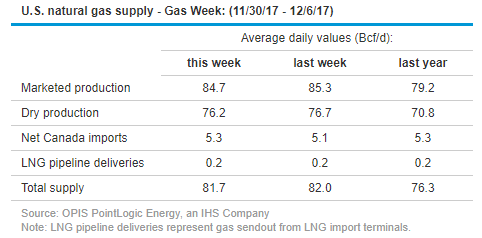

This indicates the focus remains much more on current market balance than forward weather expectations, which is no surprise given production remaining near record levels (and far above year-ago levels, per the EIA).

EIA data last week seemed to confirm such loosening with a small injection being reported when we tend to see a modest drawdown from storage. Though the data on Thursday is supposed to be more supportive, we have quickly seen any supply shortage get erased by lackluster demand and impressive production.

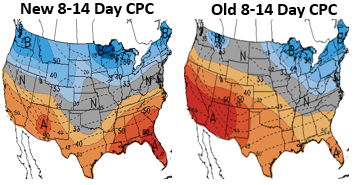

Yet beleaguered bulls are still looking towards the end of December, where we see sizable cold risks setting up that have trended even colder in recent Climate Prediction Center forecasts, as we have been warning clients.

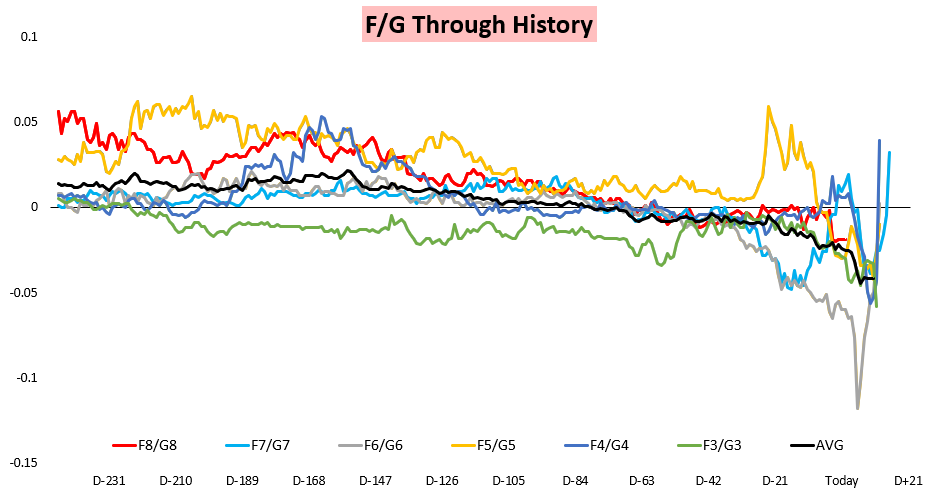

Bulls also look to past years where late-month cold has helped bolster cash prices and the January natural gas contract over the February contract into expiry.

There do remain some late-month cold risks, and we have been closely monitoring them for clients, explaining how they have been shifting overnight and what impact on natural gas prices they are likely to have.

Leave A Comment