Let’s talk about Gold.

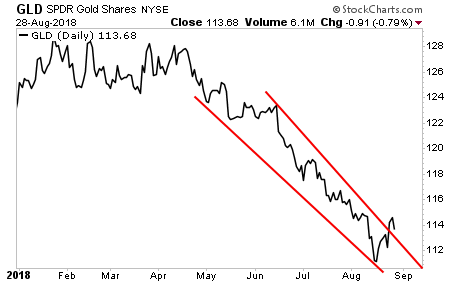

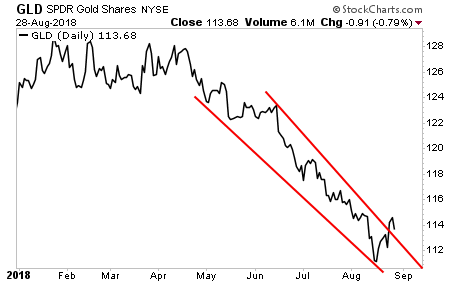

Gold has been collapsing in a near straight line since April. This has lead to traders going record short the precious metal and sentiment reaching “2008 meltdown” levels of pessimism. Gold, for most investors, has become a proverbial “four-letter word.”

Having said that, Gold has just staged its first significant bounce since the bloodbath began four months ago. The issue now is whether or not it’s a “dead cat bounce.” On the positive side, the bounce has broken the downtrending channel that has determined Gold’s price action.

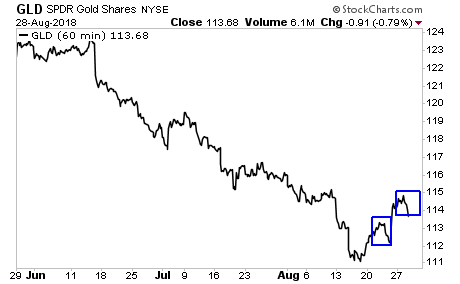

Also on the positive side, Gold has established a series of higher highs and higher lows during this bounce. And this latest correct move looks a big like the one that hit a week ago.

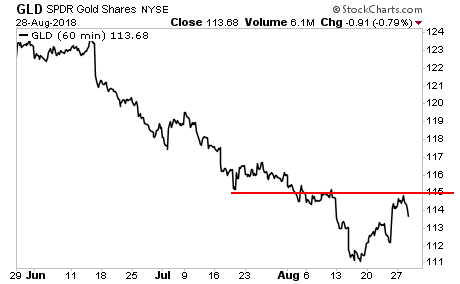

However, the bad news is that Gold has ALSO just been rejected at resistance. Had the precious metal taken this line out without difficulty, there would be serious cause for celebration. But unfortunately, Gold traders are not ready to commit the capital to make this happen.

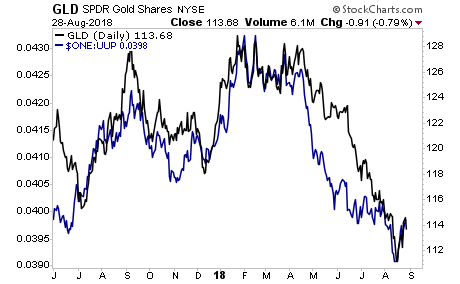

The good news, however, is that Gold is currently tracking the USD. The below chart reveals Gold (black line) overlaid with an inverted USD (so if the USD rallies the blue lines falls).

As you can see, the two are moving in lockstep. Which is why, if you’re a USD bear, and believe that the financial system is shifting into a “weak USD” phase, you’re starting to get excited about Gold again.

The long-term chart paints a nice picture of what I’m expecting. The USD has in fact been forming a series of lower lows since 2014. The next low will take us to the mid-’80s (see the red arrow).

That’s a heck of a “tell” from the markets. And it’s “telling” us that we’re about to see a major inflationary move as the USD drops hard. This will be sending Gold and other “weak-USD” plays on a major bull run.

Leave A Comment