John Grady is an independent futures trader from Florida, who primarily trades Treasury bonds. His trading is purely discretionary, based upon his read of order flow. Essentially, he’s a scalper.

Until recently, I’d never really taken the time to understand the order book and make sense of order flow. Sure, I understood the order book at it’s most basic level, but really, not much beyond that point.

Having now learned more about the subject, I feel as though it’s something I should’ve learned long ago. And regardless of whether you decide to use the order book as a part of your trading, it’s my opinion, that it’s at least valuable to understand.

And that’s the reason why I asked John come on the podcast, to share some of his insight and experience with you…

Topics of discussion:

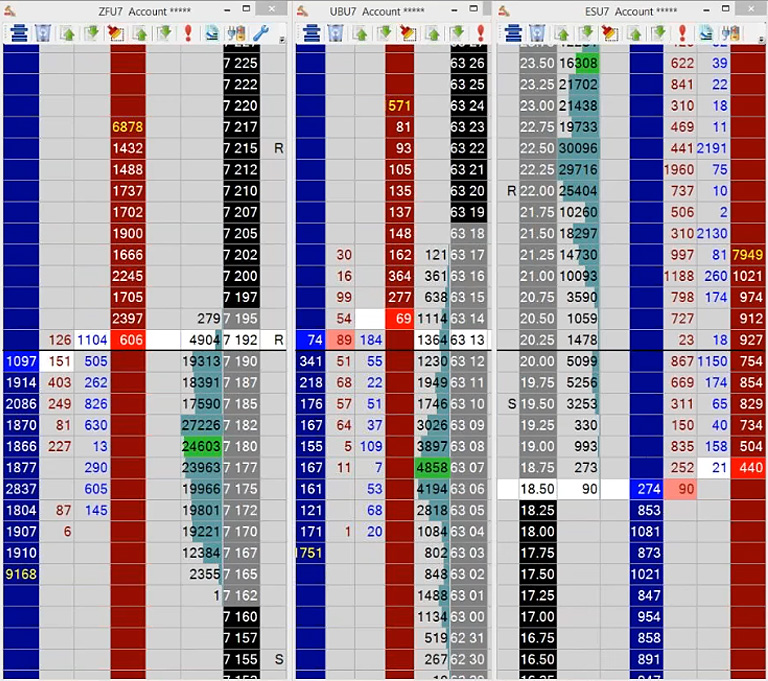

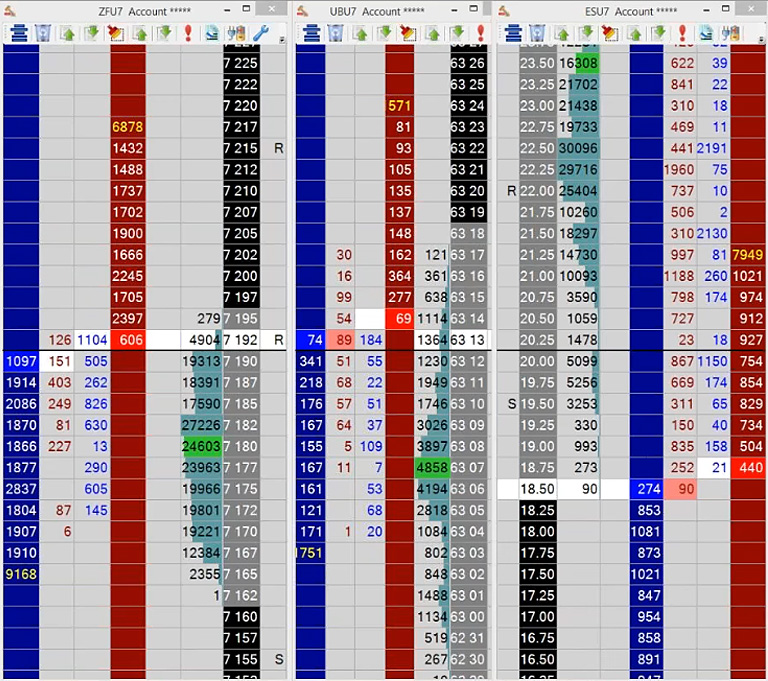

A snapshot of John’s screen, displaying three order books.

Leave A Comment