Of all the moving parts contradicting the narrative of the growing economic boom, it’s incomes that will do it the most disservice. After all, there can be no such thing without them. Until our future robot AI overlords finally descend to either free humanity from labor, or eliminate us altogether, the economy still runs on the basic capitalist premise of labor utility.

We need to work such that we don’t have to make our own clothes and grow our own food, that way we can be freed to produce our own YouTube videos. The successful exchange of labor (videos) and capital (internet infrastructure and distribution franchise) is obviously income paid at profit. If the economy is truly working well, that’s when we are all working and incomes grow robustly.

Thus forms the virtuous circle all economists and policymakers actively seek out. The more incomes rise, the more we tend to spend, the more businesses will hire to keep up with expanding revenue. On and on it goes in what we call a boom.

Almost all major economic problems can be distilled as the reverse. Consumers stop spending, business stop hiring, leading to less spending. The grand idea behind an exploitable rational expectations theory is to use primarily monetary policy to get both consumers and businesses feeling good about the future so that they act today in belief of a much brighter tomorrow.

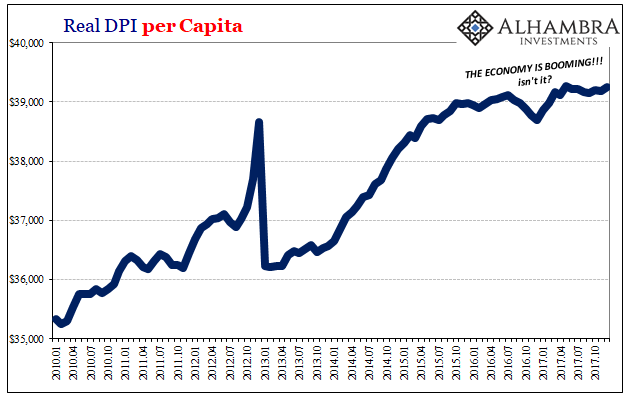

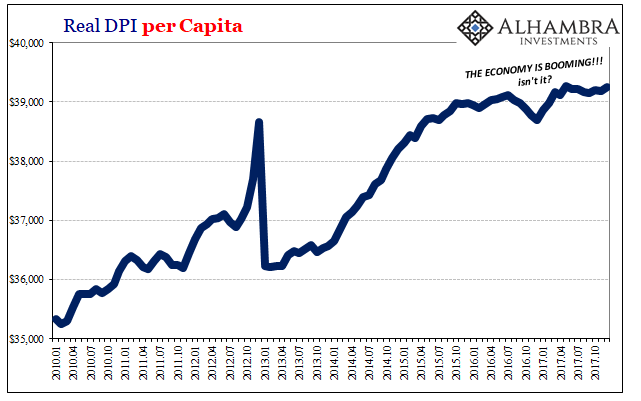

The “rising dollar” of 2014-16 produced just those sorts of negative pressures. The downturn initially hit business income, meaning profit. They responded by cutting back on the growth of inputs, managing costs to a more serious degree than they already had been doing. The labor market slowed (as did capex spending) by a considerable margin.

As a result, national (labor) income did, too. Consumer spending decelerated only by a little. The difference between those two is, of course, savings.

But what really confounds this idea of a boom is that both of those trends continued through both 2016 and 2017. Given the 2015-16 downturn, it seemed reasonable to give up on 2016. The following year, however, was widely figured to be the beginning of the upturn, the real upturn that would produce widespread recovery more consistent with past versions. It was in many ways (China the other major part) the basis for “globally synchronized growth.”

Leave A Comment