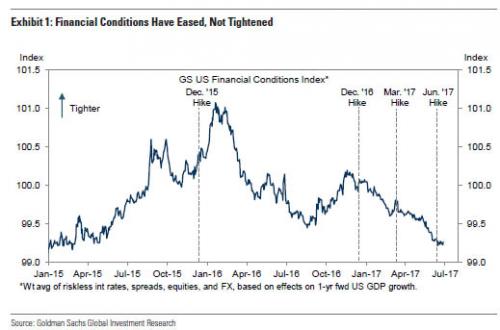

One of the recurring laments about the Fed’s hiking cycle, most recently from Goldman, is that despite 2 rate hikes so far this year, financial conditions remain the loosest they have been in over two years. Whether that is due to the market being so drunk on the Fed’s “punch bowl” it is unable to grasp the liquidity is being dragged away, or for some other unknown reason despite repeated warnings by FOMC members that stocks here are overvalued, markets simply refuse to concede that financial conditions should be tighter, in fact, as Goldman observed “so far, the Fed’s efforts to tighten financial conditions have achieved too little, not too much.”

That, in the view of Bank of America’s rates strategist Shyam Rajan is a big mistake because as he explains in his latest note titled “When paint dries, does the wall crumble?” despite the market’s repeated unwillingness to acknowledge what the Fed is doing, “recent market moves mark the beginning of a prolonged tightening of financial conditions.”

And, more notably, he underscore that despite the benign financial condition regime, the market is missing one key thing: in light of what the market perceives as a “benign flow effect” the risk currently is in the the Fed’s balance sheet “stock”and adds that “we think the market is complacent on the stock effect of the Fed’s balance sheet decline. Specifically, higher deposit betas, UST supply and/or real rates could all trigger significantly tighter financial conditions.”

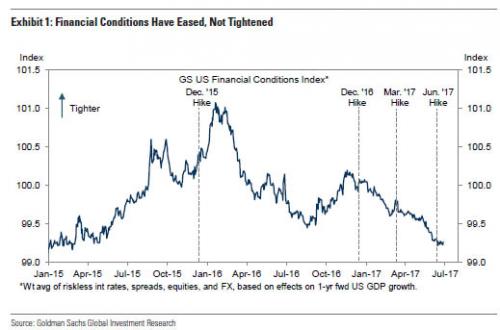

To underscore his point, Rajan shows the following chart which shows just how vast the upcoming normalization will be, in light of the moves for both inflation expectations and real rates that took place during QE2 and QE3, and how small the unwind has been so far under the Fed’s tightening regime. As Rajan explains further (more below), “ever since the conversation for the Fed shifted from hikes to balance sheet after the March meeting, we have seen a significant increase in real rates and a decline in inflation expectations: the anti-QE trade. Recall that the primary objective of an expanded balance sheet was to push real yields lower (when the nominal funds rate was constrained at 0) and inflation expectations higher. As shown in our Chart of the day, when looked at through that lens, the reversal over the last few months is just the beginning of a long process.”

Leave A Comment