Every once in a while the trading action in a given market breaks through its historically normal boundaries and starts exploring new territory. This can mean one of two things: Either something fundamental has changed, creating a “new normal” to which participants will have to adapt. Or the extreme move is a temporary aberration that will eventually be corrected by an equally extreme snap-back into the previous range.

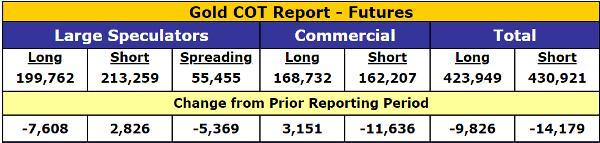

The gold and silver futures markets are posing this kind of question right now, with speculators – who are usually net long – going net short, and commercial traders – who are usually net short – going net long. The following table shows how each group traveled even further into this unfamiliar territory in the past week.

The following chart illustrates how unusual this new market structure is. During most of the past year the speculators (gray bars) have been extremely long and the commercials (red bars) extremely short. Now they’ve swapped attitudes, with speculators betting that gold is going to fall and the commercials taking the other side of that bet.

The same process is at work in silver, where the departure from the norm is even more extreme. In other words, the speculators are very short and the commercials very long.

Presented graphically, the far right of the chart illustrates just how unusual the current action is. It’s possible that these two groups of traders have never been in this relative position before.

What does this mean? Either something has happened to realign speculator and commercial trader incentives and objectives, putting them permanently on the other side of their traditional positions, or the past few weeks’ action is an anomaly that will be corrected with an extreme move in the other direction.

Which is more likely? The latter almost certainly, because the commercials’ traditional net short position exists for business reasons. Gold and silver miners frequently sell their production forward using futures contracts to lock in a predictable price, and they place their orders through the banks that make up the bulk of commercial traders. As long as the miners continue to hedge, commercial traders will necessarily tend to be net short. Speculators, meanwhile, traditionally take the other side of this trade (because every trade has to have two sides), which means they have to be net long to make the market work. So at some point the balance has to be restored.

Leave A Comment