Back in March, I recommended a broad play on platinum that’s returned 56% more than the S&P 500 over the same period.

Those gains didn’t happen by accident. You see, gold and platinum have a special relationship, the so-called “gold-platinum ratio.”

In fact, since platinum is about 30 times more rare than gold, it’s usually the more expensive of the two metals. But right now, the ratio is reversed, and gold is the more expensive metal.

That situation never lasts, and we’re actually seeing the gold-platinum ratio right itself now. It’s been partially responsible for some very nice gains in both metals recently…

Platinum prices are up more than 11% since March in a classic case of low supply and high demand.

Output from South Africa, the world’s top producer, has plunged amid dwindling capital investment and spiraling labor unrest. On the other hand, demand from car makers, the most important platinum consumers, in need of autocatalysts has surged due to dramatically higher auto sales.

What’s more, the platinum deficit is growing, and many miners have seen their share prices more than double.

Now I’ve found the one mining stock with the most room left to run. Like I said, the ratio is swinging back in platinum’s favor right now. So there’s still time to participate in this lucrative bull market and leverage your gains in the process…

…but not for much longer.

What the Platinum-Gold Ratio Tells Us Now

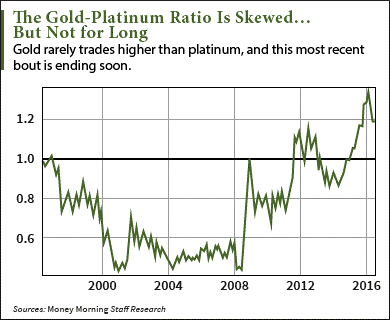

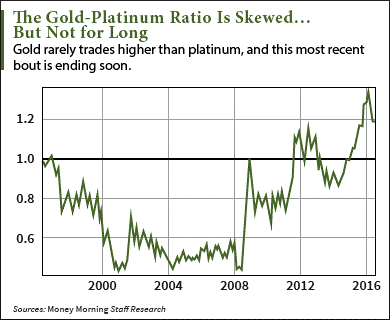

Let me show you a chart that perfectly illustrates the special relationship between platinum and gold. It’s helpful for understanding why prices are what they are now, and, what’s more, why time is running out to book maximum upside from this situation.

This is how the ratio has changed over the past 20 years…

Over that time frame, gold has averaged about 0.73 the price of platinum. But in the depths of the 2008-2009 financial crisis, the normal relationship got out of whack, and the ratio soared. It did pull back, but then kept rising and basically tripled from near 0.4 to over 1.3. Since the middle of 2015, gold has become the most expensive relative to platinum that it has been since 1997.

Leave A Comment