Jay Powell has been named the next Chairman of the Federal Reserve. Provided he survives the confirmation process, it is a done deal.

This wasn’t the easiest pick for Trump. It’s not easy to find a Republican who is also in favor of low interest rates. Powell isn’t exactly a dove, but he’s significantly more dovish than John Taylor. Or at least he was, up until the complete 180 Taylor pulled after learning he was a candidate for the job.

Powell is a private equity executive and a lawyer, not an economist—which these days, some might consider to be an asset. The professional economists have delivered on their promise of low inflation, unless you count inflation in things like houses, stocks, and bonds. He’s enough of a hawk that Bernanke at least partially blames him for being on the wrong side of the “taper tantrum” in 2013.

The journalists all seem to think Powell represents “continuity,” and Mnuchin seems to think the White House can exert some degree of control over him. That is the consensus.

As the 10th Man, I’m always looking to poke holes in consensus. So:

1) What if Powell breaks with Yellen’s water torture rate hikes, and hikes faster?

2) What if Powell interprets Fed independence quite literally, and grows a brain?

The markets could be in for a big surprise.

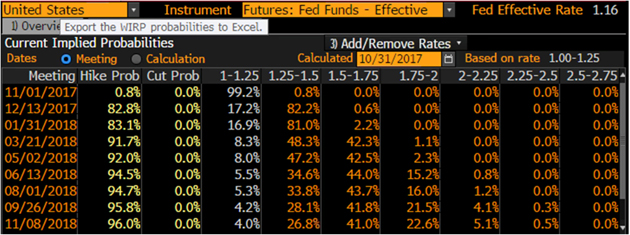

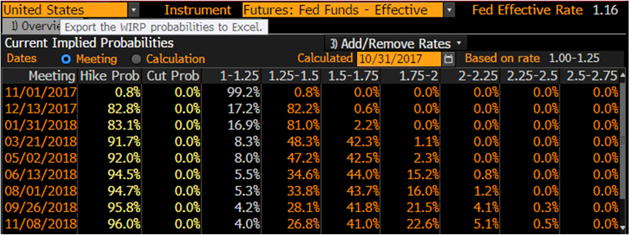

There is a screen on Bloomberg called “WIRP,” which stands for World Interest Rate Probability. You can see the likelihood of rate hikes over just about any timeframe.

Source: Bloomberg

You can see that that one rate hike is expected next year in the US. What happens if Powell grows a brain? More rate hikes, of course.

I think the market is a little mispriced.

Institutional Memory

The Fed, as an institution, hasn’t had to worry about rising inflation in 35 years. Volcker attacked it with both barrels, it declined, and kept declining for decades. For years, the Fed stayed vigilant. It would hike at the first sign of trouble. The Greenspan Fed in the late nineties would have done three 50bp intermeeting rate hikes with ISM above 60 and unemployment scaring the three handle.

Leave A Comment