Two weeks ago, Chinese stock futures traded in Hong Kong flash crashed. Between 2:14pm and 2:16pm local time on May 17, the Hang Seng China Enterprises Index suddenly liquidated due to an intense burst of sell orders that crashed through the whole of the futures market depth. At the start, the index was trading at around +1% but fell to as low as -1.5%, for a 2.5% swing in a matter of seconds.

“The market reacted like a startled cat,” Andrew Sullivan, managing director for sales trading at Haitong International Securities Group in Hong Kong, said by e-mail. “There is a lack of clarity on what is happening in China.”

It was an alarming re-occurrence since Chinese stocks though they had been recovering from the huge selloff to start the year (after last summer’s even bigger drop) are still precariously situated given an unending list of pressure points. Thus, in many ways the “irregular” trading today shouldn’t have been that surprising, either. This time, the Hang Seng Enterprises Index dropped 12.5% in seconds (from +2.5% to 10% limit down), recovering all losses within a minute of trading.

“Liquidity in the market is really thin at the moment,” Fang Shisheng, Shanghai-based vice general manager at Orient Securities Futures Co., said by phone. “So the market will very likely see big swings if a big order comes in.”

There it is; the big factor in everything in either direction. If liquidity seems plentiful, markets rise as if there weren’t a care in the world. If it is erased, then the “irregular” becomes increasingly anticipated. Liquidity isn’t liquidation, but they aren’t that far removed especially under far less than robust circumstances. In China, the warning only grows louder.

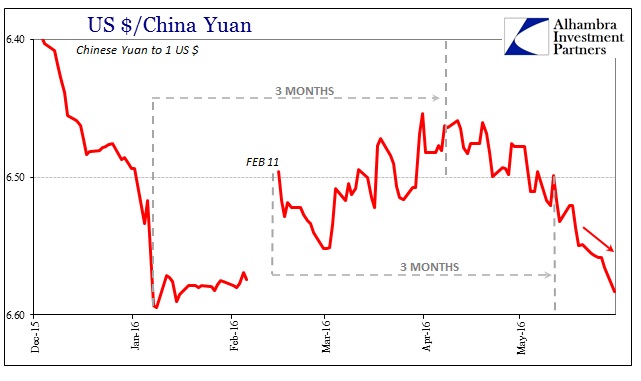

It may just be coincidence these flash crashes taking place after the passing of the second 3-month window, though I strongly doubt it. The shift in CNY indicates the increased (“dollar”) pressure from maturity of prior PBOC efforts that had created the false sense of liquidity that buoyed global markets in the first place. As liquidity tightens up or disappears altogether, all kinds of markets start acting “irregularly.”

Leave A Comment