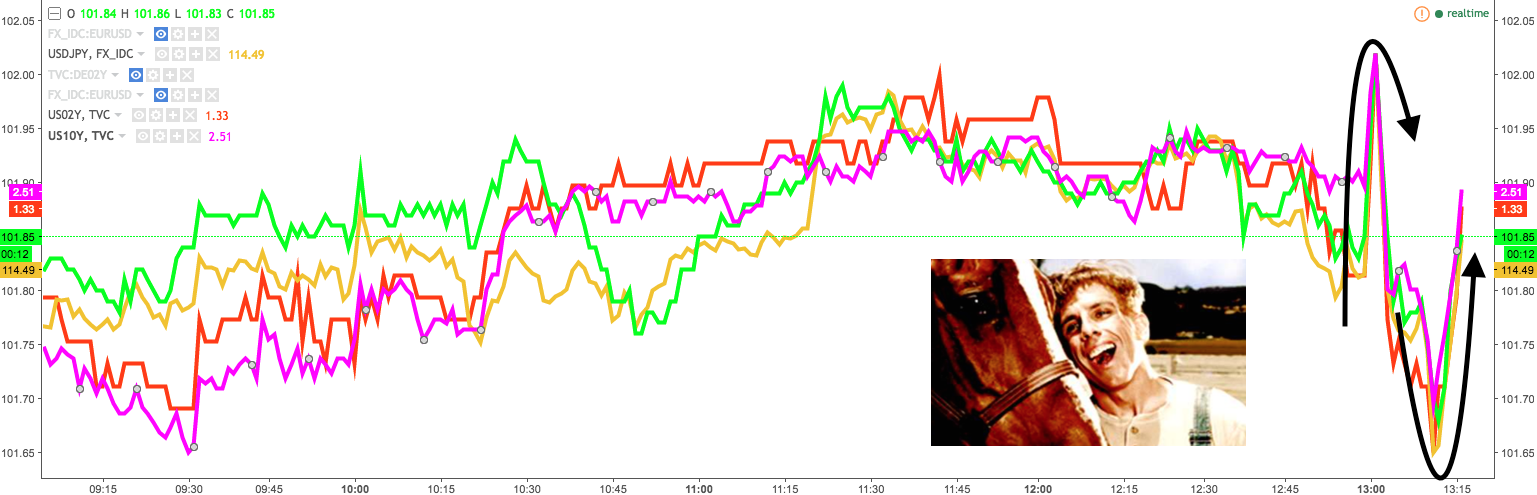

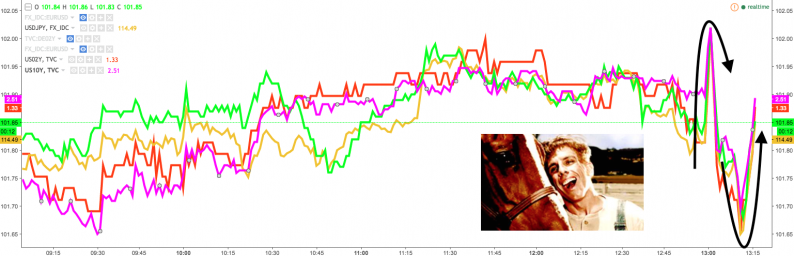

Update:

Good cop, bad cop.

First the Fed “unleashed the Bullard” to explain why the incoming econ data in fact doesn’t support a March hike.

Next up was the queen bee (Lil’ Kim reference alert). Here are the talking points via Bloomberg..

Fed Chair Janet Yellen says an increase in fed funds rate will likely be appropriate at FOMC’s March 14-15 meeting if policy makers determine that employment, inflation continue to evolve in line with expectations.

- Even so, monetary policy isn’t on a preset course; FOMC is ready to adjust assessment of appropriate path for policy if unexpected events materially change outlook

- Committee generally sees labor market strengthening further, inflation at or near 2% in medium term

- Cumulative 0.75ppt of rate increases envisioned by FOMC in December for this year would be consistent with “gradual pace”

- Slower-than-expected increase in rates during those years reflected more than just inflation, job market and overseas developments; surprisingly sluggish productivity growth in U.S. and abroad suggested that fewer hikes would be needed than previously thought

- Job gains have remained solid, 4.8% unemployment is in line with median FOMC estimate of long-run normal level; higher energy prices may have temporarily boosted inflation

- Prospects for further moderate economic growth look encouraging, risks from abroad appear to have receded; risks to outlook are roughly balanced

- Unwelcome developments reflect structural hurdles that are beyond reach of monetary policy

Leave A Comment