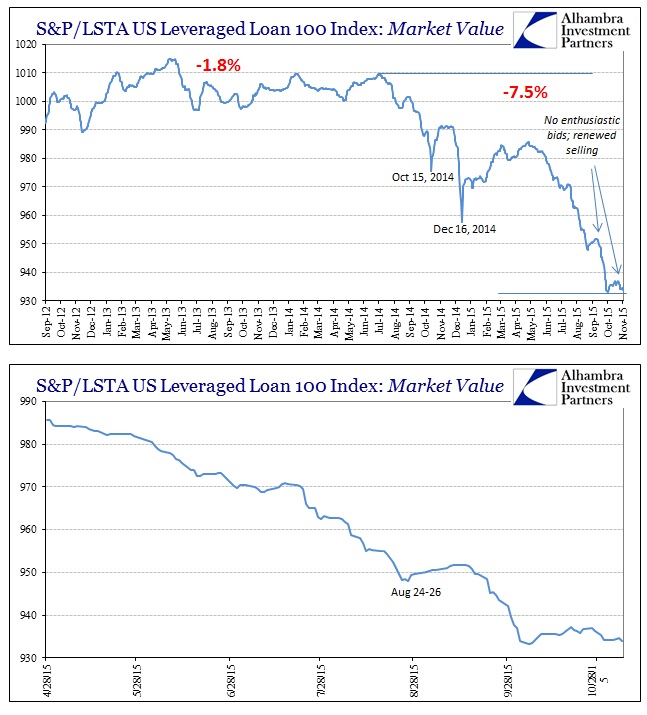

While the stock market had one of its best months in years, it was, like the jobs report, uncorroborated by almost everything else. The junk bond bubble, in particular, stands in sharp and stark refutation of whatever stocks might be incorporating, especially if that might be based upon assumptions of Yellen’s re-found backbone. Do or do not, corporate junk remains unimpressed and therefore depressed against the same background drowning as has been in place going back to June 2014.

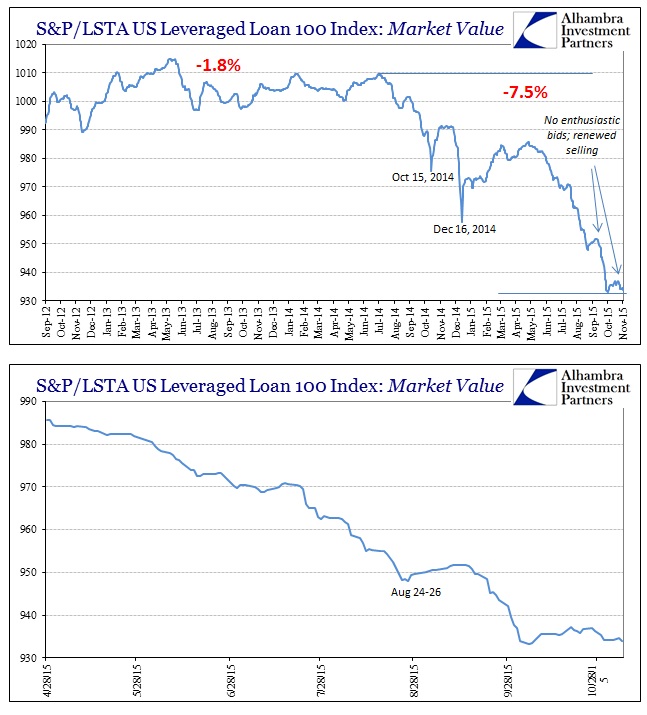

At yesterday’s close, the S&P/LSTA Leveraged Loan 100 index had fallen back to only a few fractions above its early October multi-year lows. That price action was matched by other high yield, high risk bond views.

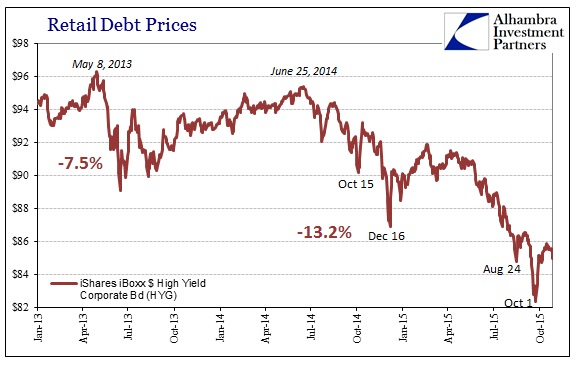

Retail junk debt prices have been somewhat more responsive which isn’t surprising given the mood in general stocks (or at least the narrowing segment of stock markets and indices that are rising). Though more so than institutional, even retail junk prices have begun to turn around again of late.

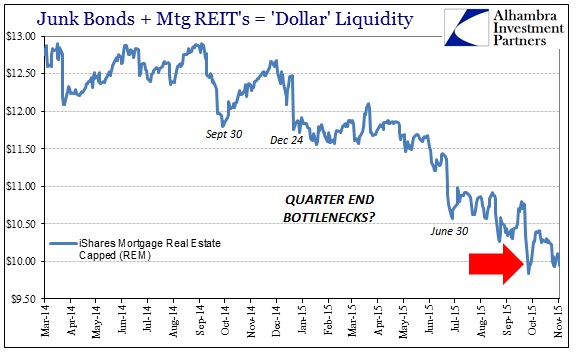

Undoubtedly, part of that is due to what can only be termed and categorized as atrocious liquidity conditions. The mortgage REIT ETF REM suggested a quarter-end liquidity bottleneck at the end of September before rising as HYG (the two are well-correlated). However, in recent days REM has sunk almost to that late September nadir, suggesting, firmly, that “dollar” funding and perceptions are continue to be far more problematic than the unspecifiable euphoria elsewhere.

The recent turn toward “hawkish” opinions about FOMC predilection has sparked some noteworthy returns in “dollar” proxy currencies, especially the franc. The Swiss currency had been trading in bouts of appreciation which tied closely to upwelling in fear and safe haven demand. Around October 21, however, the franc suddenly fell under a sustained bout of depreciation that has brought it to parity with the dollar. That is almost the same disastrous level that forced the SNB to noisily and dangerously abandon the euro peg back on January 15. Whether that relates to the changing views of monetary policy isn’t fully clear, but it would be a reasonable assumption especially as this return is matched by other currencies such as the Indian rupee.

Leave A Comment