It was all about taxes on Friday as Marco Rubio said he would back the bill following a compromise on the child tax credit. And then later in the session, this:

So that’s “Little Marco” and “Liddle Bob” on board. It looks increasingly like this deliberate plan to make the rich richer is going to be implemented under the guise of a “Middle-Class miracle.” I hope you asked Santa for a corporate tax cut for Christmas.

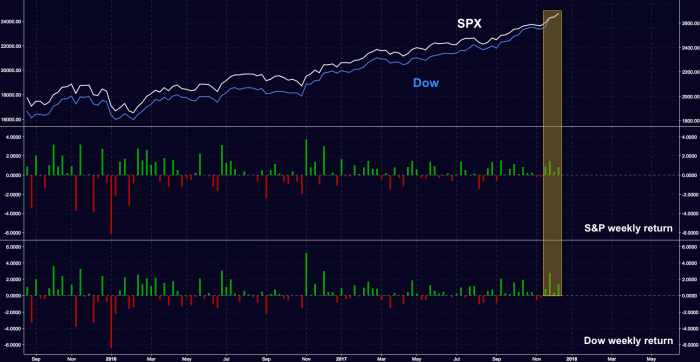

And speaking of the rich getting richer, stocks rose for a fourth consecutive week with the Dow and the S&P closing at fresh record highs.

Since the tech selloff on November 29:

On that point, consider the following from JPMorgan’s 2018 year-ahead preview:

We recommend investors OW Value, stay Neutral Growth and Momentum and UW Quality and Low Vol. We have been positive on Growth and Momentum Styles since early 2017 arguing that a maturing business cycle favors Growth over Value. Growth has outperformed Value by ~14% (long/short) YTD and it now appears significantly stretched based on relative valuations, its alignment with Momentum and the macro backdrop. We had also noted that Value will need a specific catalyst (i.e. Tax reform, reaccelerating growth, higher oil) to regain its leadership. Most of these catalysts now appear to be in place and leading us to recently advocate rotation to Value from Growth.

The dollar rose for a second day, buoyed by tax optimism and a steep decline in the pound. The two-day win streak comes on the heels of rough Wednesday when the greenback dove following on a CPI miss and the market’s dovish interpretation of the messaging around the Fed hike. Prior to that, the broad dollar had risen for seven consecutive sessions in its best run of the year:

Here’s an annotated chart:

We got some bear flattening on Friday and with it, the 5s30s fell below 53bps for the first time since October 2007:

Leave A Comment