My Swing Trading Approach

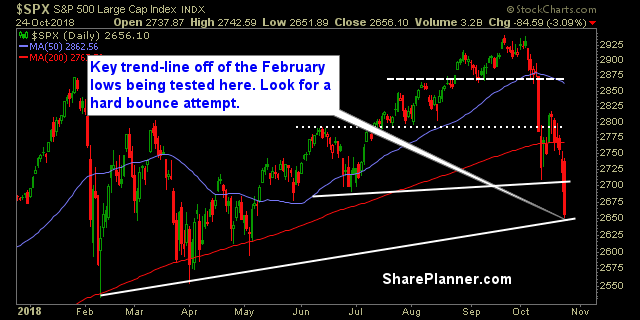

I have identified some key trade setups that I want to take a stab at right out of the gate this morning. Should this bounce hold today, and in the days ahead, the potential for a 100 to 150 point move for SPX looms very, very large and could be one of the best bounce opportunities of the year.

Indicators

Sectors to Watch Today

Utilities and Real Estate held strong and is expected in a correction. For the bounce to play out and hold strong, Technology, Discretionary and Industrials will have to participate and lead the way.

My Market Sentiment

Capitulation-like price action into the close yesterday with a 3% decline to take SPX negative on the year. Now the rising trend-line off of the February lows are being tested. Critical area of support here.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment