Crude took a rather precipitous dive on Friday in the wake of a veritable gut punch from Petro–Logistics, who said OPEC supply in July is expected to exceed 33 million barrels a day. That would be the highest since December 2016.

That rather unfortunate (if you’re a bull) development undercut what was otherwise a half-decent week that saw another batch of ostensibly bullish data (rising production notwithstanding) and more hints that the Saudis are getting serious about propping up prices.

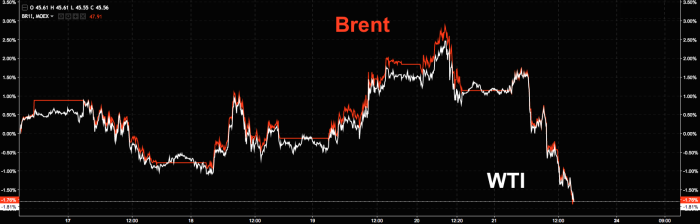

As you can see, the price action on Friday underscored the notion that this market is looking for excuses to sell off and still suffers from an acute crisis of confidence:

Meanwhile, investors are still asking the same question: at what point do jitters about crude and attendant widening in energy spreads spill over into the larger HY market?

This is a subject we’ve covered extensively in these pages and one particularly interesting thing to note is that this appears to be a rare case where credit is lagging equities in terms of pricing in reality.

And while credit has indeed remained resilient, the most recent downturn in crude wasn’t digested as well by HY Energy names and that validated something we said way back in January: namely that the notion that HY Energy should trade inside of HY as a whole was patently absurd given the backdrop.

(Citi)

You can trace that amusing story back to its origin starting here.

On this score, Goldman notes that “for HY Energy credits, the recent gyration in oil prices carried a slightly different flavor [as] unlike previous episodes of volatility in the crude market, the relative performance of HY Energy credits vs. the broader HY market has turned somewhat more responsive to the performance of crude.”

Ok, so that gets us back to the original question about when this will spill over into the broader HY market. Here is Goldman’s answer:

Leave A Comment