What do consumers know that Economists don’t? It’s a loaded question, of course, particularly in this day and age where Economists spend years perfecting the study of mathematics. In many ways, formal training is an impediment to the analysis of the economy. There’s nothing wrong with learning about regressions, but it can and often does appear to take away from intuitive capacities for the real world. The math becomes “more real” than actual experience.

It is a form of corruption, where confidence in the modeled projections becomes unshakable as more evidence piles up against it. The recovery and boom (therefore inflation) may not be here today, but the more today’s that pile up without that happening the more it must tomorrow. Models are never wrong, for Economists, they are always early – seven years early (and counting).

The University of Michigan reported last week that long-term inflation expectations among consumers matched their lowest level on record this month. The expected average annual change in consumer prices over the next five years was for consumers just 2.3%. The only other time in almost three decades of surveys the long-term inflation outlook was this small was December 2016.

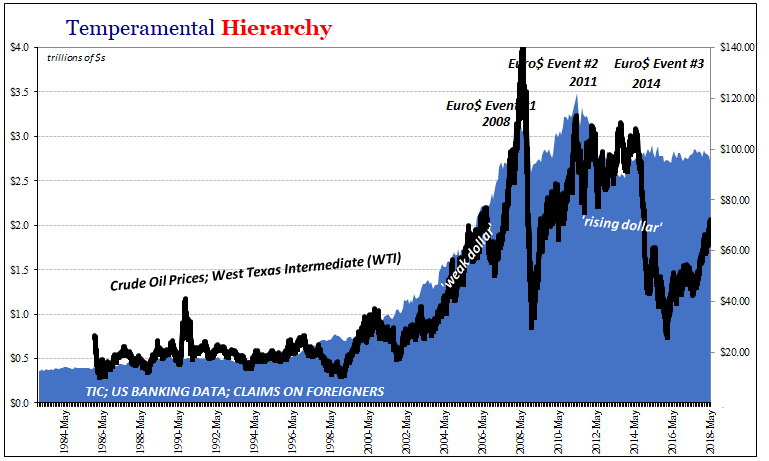

For Economists, this can’t possibly be; or, as many of them have expressed since the middle of 2014, consumers are just irrational and/or illiterate. About statistical mathematics, that is very likely so; about the economy, it is almost surely the other way around. Since they’ve never studied the often great difficulties when confronted by heteroskedasticity Economists believe consumers can’t possibly know what they are talking about with regard to the general effects of oil and commodities.

Where DSGE models fail to include financial markets, or even just monetary conditions, consumers don’t have the luxury of remaining blind year after year of little or no legitimate economic growth. They know a recovery when they see one, and this ain’t it. It may be called a strong economy, but consumers continue to point toward something else entirely.

Leave A Comment