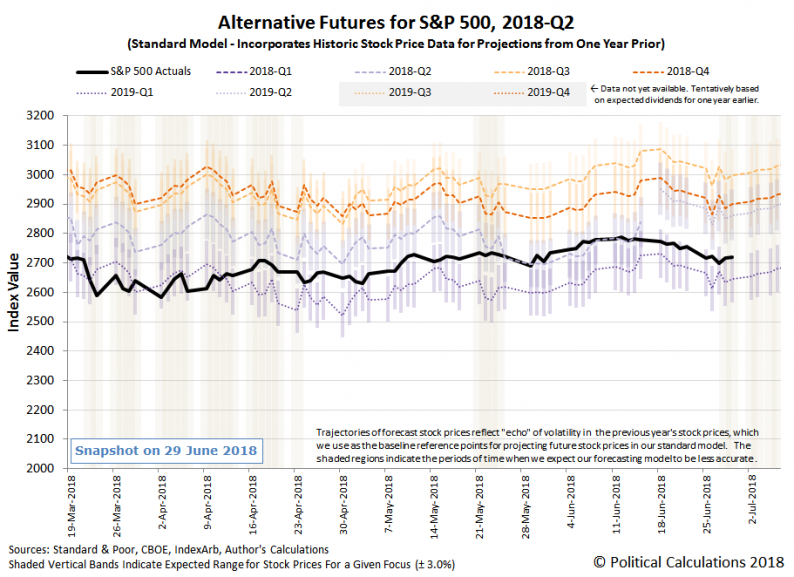

We know that this next week will be a holiday week for U.S. markets, so we’re just going to go straight to the charts this week to recap the fourth and final week of June 2018!

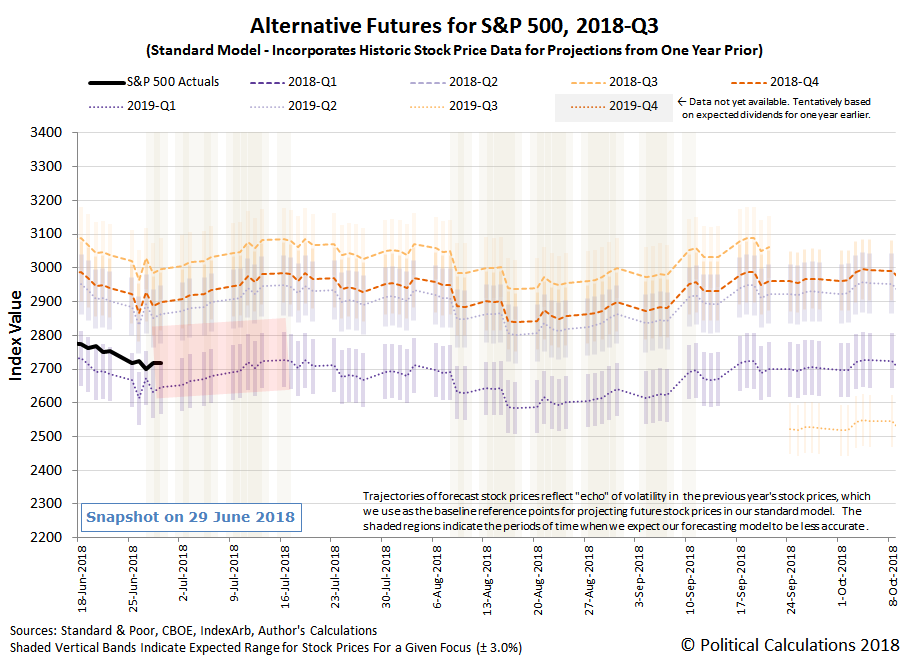

Because we’re at the end of 2018-Q2, it’s also time to look ahead into the alternative futures of 2018-Q3…

We’ve added a “redzone” forecast to our 2018-Q3 alternative futures spaghetti forecast chart, which we periodically do when the projected trajectories we indicate are skewed due to the past volatility of stock prices, which occurs because we incorporate historic stock prices as the base reference points from which we project the future in our forecasting model.

In this case, we’ve assumed that investors will remain largely focused on the distant future quarter of 2019-Q1 in setting current-day stock prices, where we think our model’s projections will undershoot the actual trajectory that the S&P 500 will take. At least in the period from 28 June 2018 through 16 July 2018.

Let’s get to the week’s more notable market-moving headlines of Week 4 of June 2018.

Monday, 25 June 2018

- US-China Relations: Trump Administration To Restrict Chinese Investment In US Tech Companies

- U.S. Treasury’s Mnuchin says new investment curbs not specific to China

- China’s Xi Tells CEOs He’ll Strike Back at U.S.

- Trump adviser Navarro says investment restrictions won’t be global

Tuesday, 26 June 2018

- Fed’s Kaplan says China is real threat on trade

- Atlanta Fed’s Bostic: Trade moves raising downside risk to U.S. economy

- Thanks To Tax Cuts, Companies’ Overseas Profits Now Flooding Back To U.S.

Leave A Comment