In mid-November, just days after Barclays released its 2018 equity outlook with the title “Rational Exuberance”.

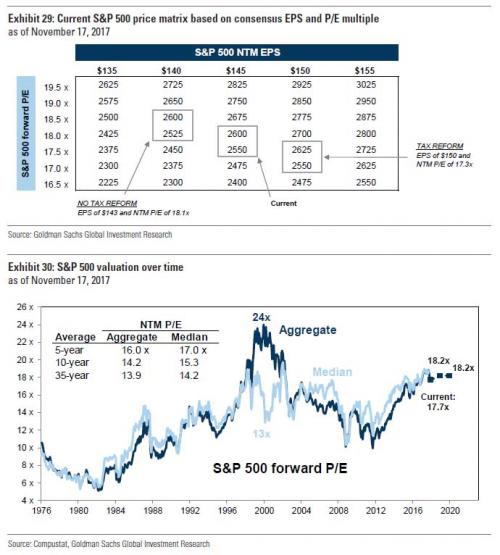

Goldman’s David Kostin decided that imitation was the sincerest form of unveiling a non-contrarian year-end forecast, and in presenting his revised S&P price target for 2018 of 2,850 – which accounts for GOP tax reform – “borrowed” the Barclays title for his own year ahead preview … despite admitting that valuations have never been higher, thus suggesting that contrary to the title, the exuberance is anything but rational.

To be sure, despite their hyperbolic titles, both Barclays and Goldman simply went with the sellside flow: in fact, in addition to Barclays and Goldman, Wall Street strategists polled by Barron’s said they expect about a 7% S&P gain for 2018 same as basically every single year, according to Sentiment Trader who points out that “they’re not stupid, they go with the base rate.” Indeed, there is power in numbers, because if everyone is wrong about the year ahead, it is the same as nobody being wrong, something Wall Street discovered in 2007.

And yet, with not one but two banks mangling Alan Greenspan’s infamous words to justify their late cycle bullish outlook which both admit is not deserved on a fundamental basis, Goldman’s clients remain confused, and in his Weekly Kickstart, Goldman’s chief equity strategist David Kostin writes that he has spent the last two weeks meeting with investors to discuss his outlook for US equities in 2018, including the impact of tax reform.

Our Nov. 21 reportdecided that imitation , describes our expectation that 14% EPS growth, driven by healthy economic growth and a 5% boost from tax reform, will lift the S&P 500 index to 2850 by year-end 2018 (+8%).”

While it will hardly come as a surprise, Kostin confirms that as we reported last week most investors remain exceptionally bullish despite the all time high in the S&P and despite record valuations, instead betting that the Fed will always step in to keep the upward mometum in risk assets; still while “most clients agree with our bullish sentiment but they questioned several of our specific views.”

Leave A Comment