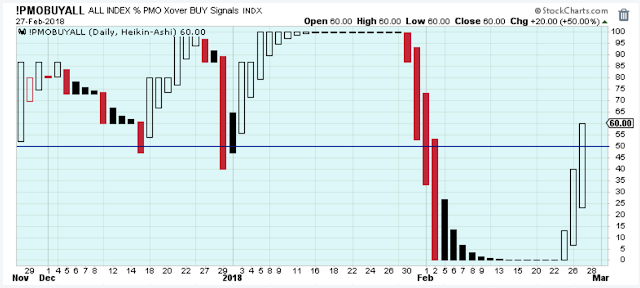

The short-term trend continues to point higher as shown by today’s tick higher in the PMO index.

The best period of time in the short-term trend for purchases is when this index is moving higher after scrapping along the lows. When it gets to the top of the range, it will be time to let positions ride higher while watching for signs that the short-term uptrend is weakening.

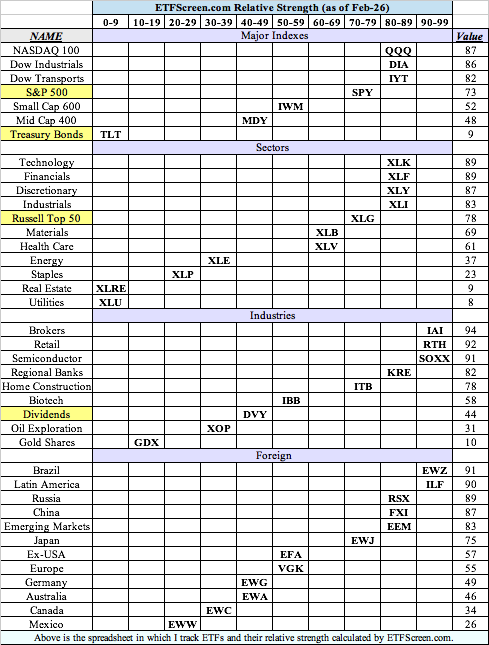

Sector Strength

Below is my spreadsheet of the ETFs that I monitor, and their associated relative strength scores from ETFScreen.com. When the market dips, I like to buy the ETFs with the highest scores.

I think it is really interesting to see which ETFs are outperforming after a sell off. I am a bit surprised that Technology continues to lead, but I am also happy to be an owner at the moment. At some point, though, I think rising interest rates will start take a toll on the Tech stocks. The RS scores should do a good job of telling us when that starts to happen.

The semiconductors attempted to break out today, but were turned back by the broad based selling in the general market. However, I don’t think it will be long before we see new closing highs for this index.

The defense stocks continue to amaze, but this wasn’t one of their best days as they started to break out, but then closed with a bearish outside day.

One of my favorite ETFs has been this IBD 50 fund, but now I am out of it because it is under-performing. I don’t really know why this ETF is now under-performing, and maybe it is temporary. I do think, though, that the general market uptrend is healthier when it is led by the type of high-growth, small-cap stocks in this ETFs. In other words, as long as this ETF under-performs, it raises the caution flag a notch for all stocks.

Leave A Comment