When crypto volatility is high (like it is now), buying coins can be intimidating.

How can the average person hope to time it right?

If you blindly guess, you may buy a cryptocurrency only to watch it drop 25% over the next week.

That’s why I use technical analysis (TA) to help time buys. It works perfectly well with cryptocurrencies.

The most commonly used TA tool in crypto, the relative strength index (RSI), is famous for its simplicity.

It’s a momentum indicator that uses a rating scale of 1 to 100.

RSI measures recent momentum, typically over a 14-day period. It gives you a very simple way to judge if a coin is relatively cheap or expensive.

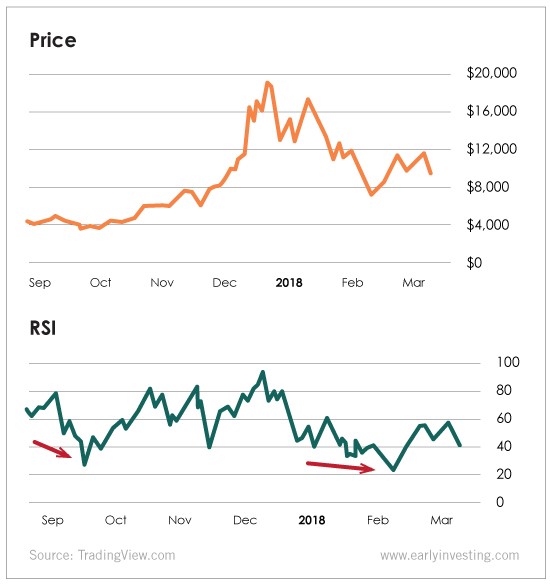

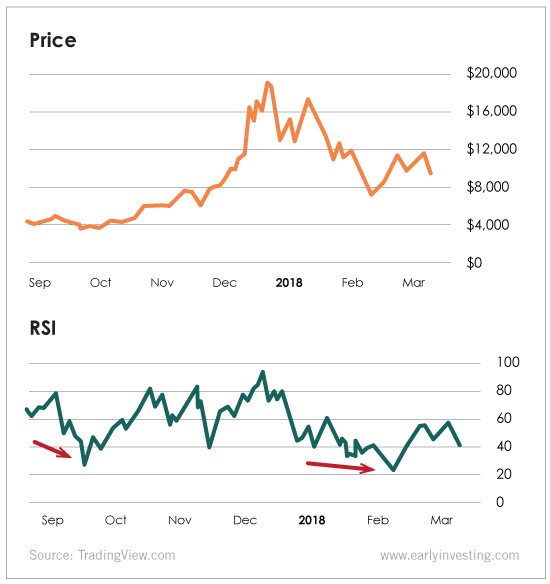

Let’s take a look at a real-world example.

Over the last year, bitcoin has entered “oversold” territory three times (on a 12 month chart)…

As you can see, RSI can be a great tool for spotting dips in bitcoin. Here’s a partial chart showing the September 14 and February 6 “oversold” triggers…

As I write, on March 8, 2018, bitcoin has an RSI value of 42, meaning it’s neutral or slightly oversold at the moment.

Buying When It’s Terrifying

Buying crypto during a pullback can be hard to do. You know it’s a better time to buy than when the price is far higher, but all the news headlines are negative. For many people, it’s hard to pull the trigger in this environment.

By using a tool like RSI to gauge whether a coin is at a favorable price, we can remove the emotion from buying decisions.

You can make these types of charts for yourself at TradingView.com. You’ll need to sign up for a free account, then click the “Interactive Chart” button on the graph. Then under “Indicators,” select “Relative Strength Index.”

Leave A Comment