THE EURO EXPERIMENT

It was always blatantly clear that an EU monetary union would inevitably require a political union to centralize decisions about tax and public spending. Without this occurring it was a misconceived and terrible blunder (that some of us argued it was when it was initially constructed) but it is turning out to be even worse than we originally perceived because of its underpinning Euro currency.

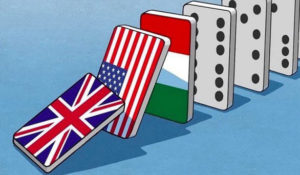

We are now witnessing that the EU experiment has become so damaging and divisive that public opinion will now never tolerate a political union. So not only was the cart put before the horse, but the horse will not now contemplate even following the cart at a distance!

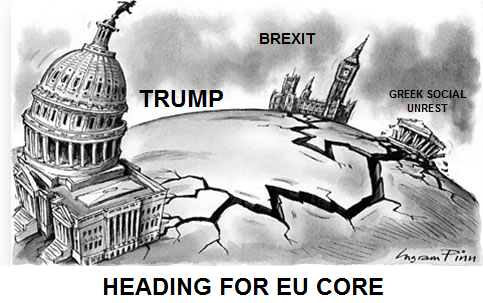

One of the reasons is that it has made countries, like Italy, Spain, Portugal and Greece, poorer while others got richer. Forcing many countries to have the same interest rates and exchange rate was foreseeable always going to be a problem, as it would lead to some countries having booms followed by big busts, as has happened in Ireland, Portugal and Spain.

It has lead to per capita income of Italians for example being lower now than in 2000, which is why they are – not surprisingly – getting increasingly restive, while in the meantime, the German economy has kept on growing, and the average German is about 20 per cent better off over the same period. The euro is a cheaper currency than the Germany Mark would have been if it still had the deutschmark, while it is more expensive than Italy would have if it still used the Lira. Germans therefore keep exporting easily and running up a surplus, while the Italians struggle and go deeper in to debt.

Furthermore, the freedom of movement of capital in Europe probably makes this worse – why would you put your euros in an Italian bank when you can invest them in Germany? Membership of the euro has thus put the Italians (and what we once politically incorrectly referred to as the PIGS) on a permanent path to being poorer.

Simply stated, the euro zone doesn’t have the fiscal or banking unions it needs to make monetary union work, and it’s not close to changing that. In the meantime, the euro’s continuing flaws continue to suck countries into crisis. And their politics get radicalized out of misunderstood populist frustrations.

A FAILED CURRENCY

The Atlantic pointed out the flaws the Euro was facing back in 2013 shortly after the EU Banking Crisis, which has been steadily deteriorating since as result:

Leave A Comment