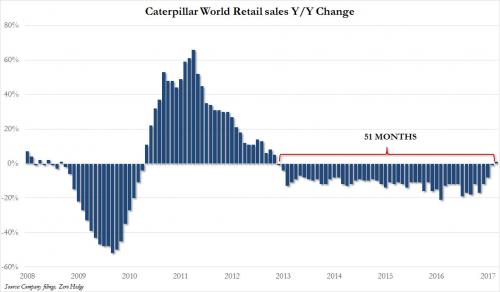

After 51 consecutive months, the dead CAT spell is finally over.

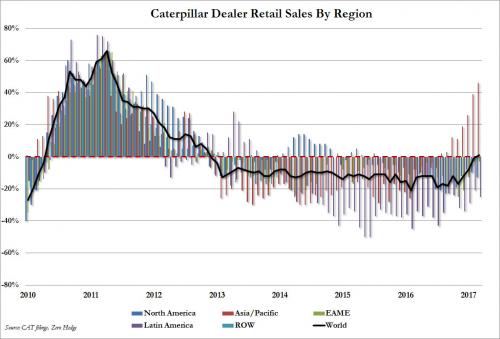

On Monday, traditionally just ahead of earnings, Caterpillar reported that in March its world retail sales rose 1% Y/Y, the first increase since November 2012. The reason: Asia/Pacific, also known as China, which saw a 46% surge in total machine sales, up from 39% last month, and the best Asian performance going all the way back to April 2011. Aside from China, however, the drought remained as every other region posted a decline in annual sales, led by Latin America (down 25%), North America (down 13%) and EAME (down 3%).

Looking at a breakdown of what kinds of machines drove the global rebound, it was all construction related machinery, which rose 7%, once again entirely due to China, where sales soared by 56% as all other geographic regions posted negative sales. Elsewhere, the contraction among resource industries continued, with world sales down 19%, and even China declining by 1%. The only region higher, perhaps predictably, was EAME where sales of resource machines rose 23% in March.

Finally, looking at the type of Energy and Transportation machines sold, Power Gen, Industrial and Transportation all declined( -7%, -6% and -3%, respectively), while Oil and Gas rose by 15% in March.

Putting it all together, the following chart of CAT global retail sales.

As a reminder, the last cycle peaked in early 2011, just as the latest Chinese credit impulse peaked and rolled over, something it has also done in recent weeks. As such, CAT retail sales may be the best concurrent, or slightly lagging, indicator of the Chinese reflation trade, which as UBS explained recently is the fundamental driver behind the global reflation impulse.

Leave A Comment