Each week Value Line publishes their list of 1700 stocks and ranks them in relative order 1-5. I took the top 100 ranked 1 and the next 300 ranked 2 for relative price performance over the next 12 months and sorted them by the Barchart technical buy signals.

The top 5 were Caseys General Stores (NASDAQ:CASY), Facebook (NASDAQ:FB), Expedia (NASDAQ:EXPE), Activision Blizzard (NASDAQ:ATVI) and Dycom Industries (NYSE:DY).

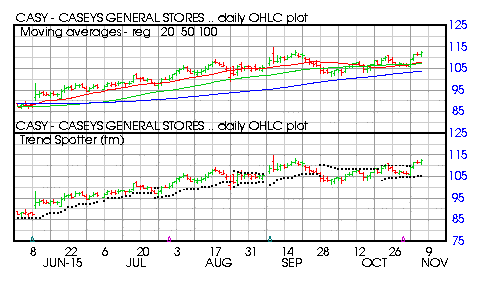

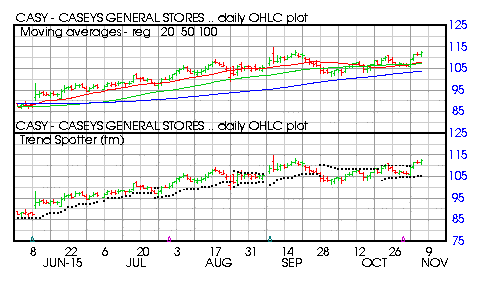

Caseys General Stores

Barchart technical indicators:

100% Barchart technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

14 new highs and up 8.06% in the last month

Relative Strength Index 65.05%

Barchart computes a technical support level at 109.93

Recently traded at 112.31 with a 50 day moving average of 107.28

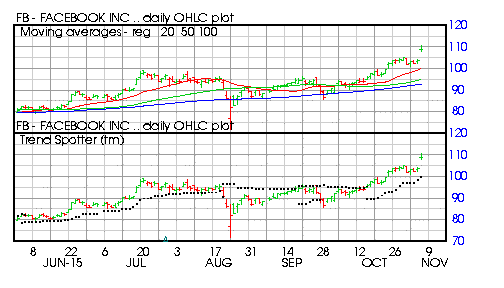

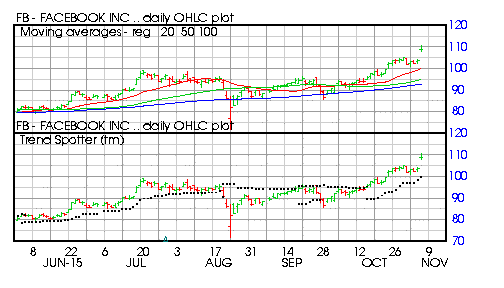

Facebook

Barchart technical indicators:

100% Barchart technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

14 new highs and up 16.21% in the last month

Relative Strength Index 74.26%

Barcart computes a technical support level at 101.86

Recently traded at 108.83 with a 50 day moving average of 94.92

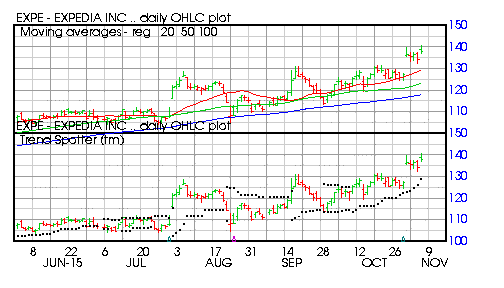

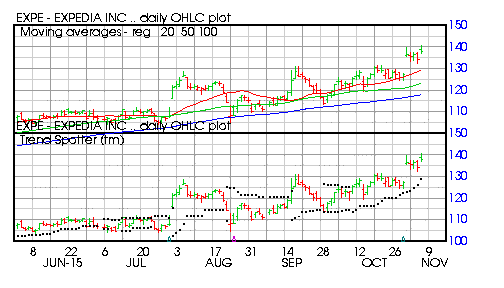

Expedia

Barchart technical indicators:

100% Barchart technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

9 new highs and up 11.55% in the last month

Relative Strength Index 65.91%

Barchart computes a technical support level at 129.84

Recently traded at 138.00 with a 50 day moving average of 123.08

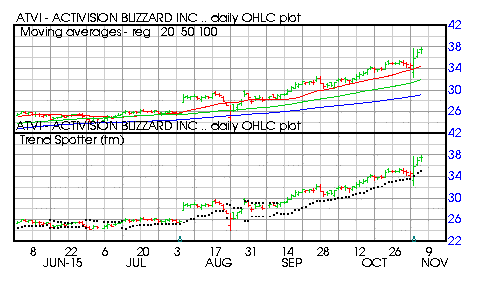

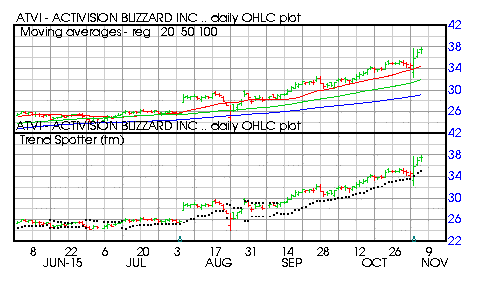

Activision Blizzard

Barchart technical indicators:

100% Barchart technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

11 new highs and up 16.70% in the last month

Relative Strength Index 80.78%

Barchart computes a technical support leve at 35.30

Recently traded at 37.33 with a 50 day moving average of 31.92

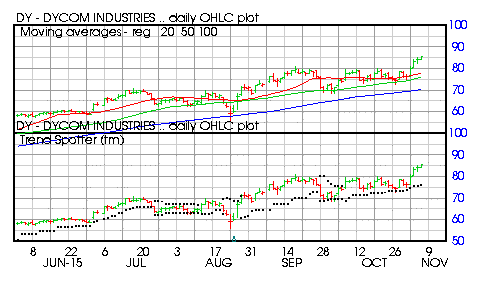

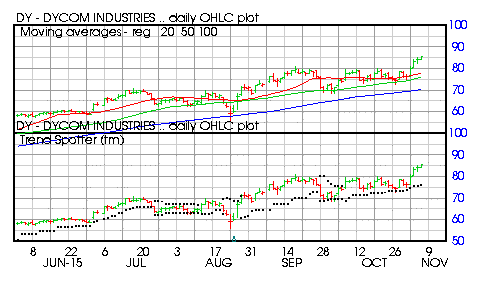

Dycom Industries

Leave A Comment