With the global economy sliding into recession, the one strawman repeatedly used by straight-to-CNBC pundits to justify some mythical case for US decoupling has been that US corporate profits are “fine.” Here is the truth.

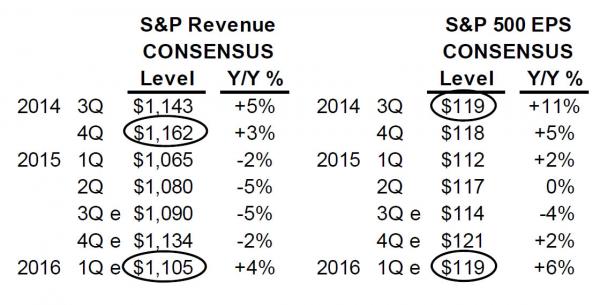

As the following table from ISI shows, not only is the US now officially in a revenue recession, with every single quarter in 2015 set to post a decline from the previous year, with even the overly optimistic consensus case of a 4% increase in Q1 2016 revenues unable to regain sales last seen in Q3 2014, but S&P500 expected earnings in Q1 2016 of 119, a 6% increase from the previous year, will barely be back to levels seen in Q3 2014.

As ISI summarizes: “Expected Earnings for the S&P Show No Growth For 7 Quarters And Revenue Declining.”

And this with nearly $1 trillion in projected stock buybacks for all of 2015 steadily removing S from the EPS calculation.

All we can add to the above is that if the USD continues its steady ascent, as it did today despite the Fed not hiking, expect ongoing dollar strength and the resulting commodity weakness to depress both revenues and sales even further, until everyone is forced to admit that the S&P500 is already in both a revenue and profit recession.

Leave A Comment