Too much mal-invested, Fed-fueled, hope-driven “if we build it, they will buy it” inventory… and not enough actual demand. This has never, ever, ended well in the past – so why is this time different?

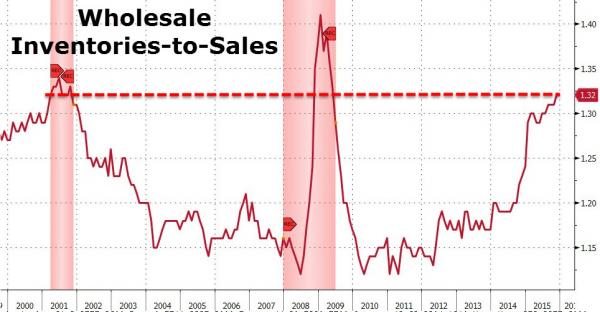

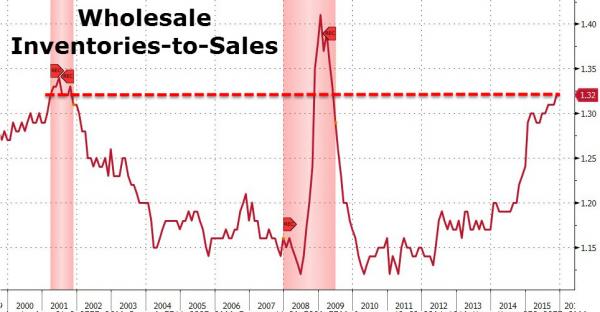

At 1.32x, the December inventories/sales ratio is drasticallyhigher than at year-end 2014 and is back at levels that have always coincided with recessions…

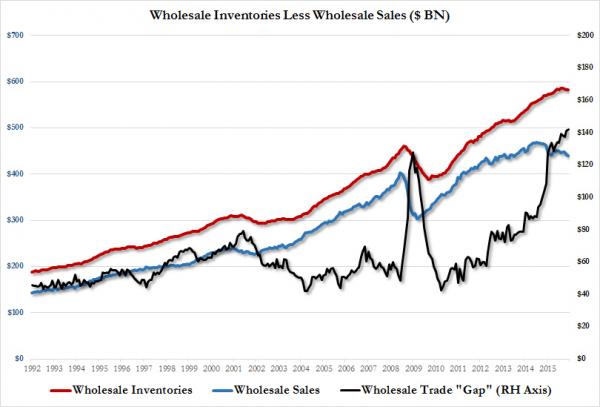

And just in case you needed more convincing that all is not well – the current spread between sales and inventories is now at a record absolute high…

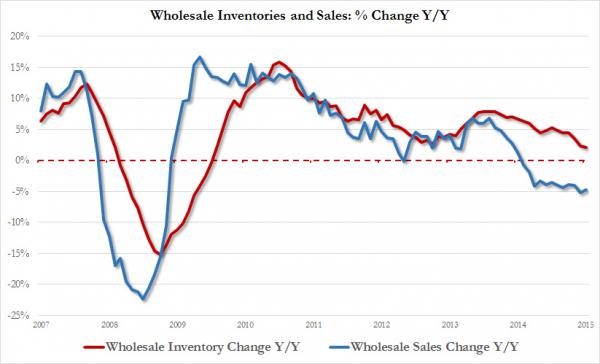

As Sales tumble and inventories continue to rise…

And all because The Fed (ZIRP) and Government (Subsidies) are breathing life into Zombies when they should be dead and gone.

Leave A Comment