My Swing Trading Approach

I reduced my long exposure yesterday, after hitting my stops in two of my trades, and adding one new additional trade. With the market gapping higher, I plan to play it cautious today and see whether the bulls can hold the gap up this morning.

Indicators

Sectors to Watch Today

Energy broke out of consolidation yesterday in a big way and led the market as the strongest sector and only one of three sectors that traded higher. Very impressive run, but also overbought, following a rally in nine of the last 10 trading sessions. Healthcare continues to establish new all-time highs. Technology had a hard bounce off of its 50-day moving average. Discretionary struggling following a two-day pullback here at overhead resistance. Financials failing to sustain a breakout as usual, giving up much of last week’s gains.

My Market Sentiment

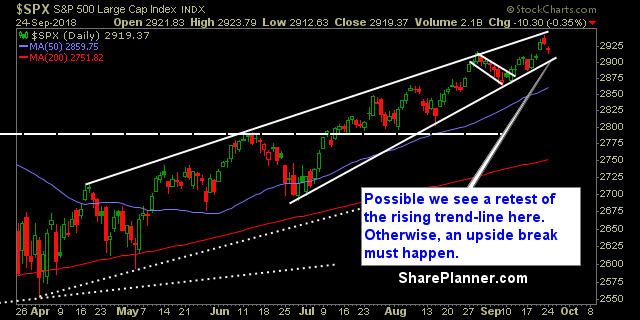

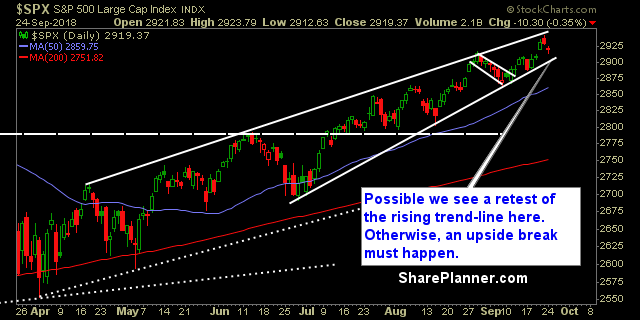

Bullish move in the premarket today, that could ultimately lead to a breakout to the upside of the bearish wedge that has formed. There is a lot of headline in the market right now as well, with Trump’s U.N. speech, Trade War with China, Rosenstein’s meeting on Thursday, FOMC tomorrow.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment