Negative Divergences Persist

Following Friday’s payrolls report, the stock market rallied quite a bit, although it is not really clear why. It sold off a day earlier, allegedly out of “disappointment” over Mario Draghi not inflating enough (which is utterly absurd), and then rallied on Friday on growing certainty that Ms. Yellen would soon act to slow down monetary inflation further. It simply doesn’t make much sense.

Photo credit: Rene Mansi / Getty Images

However, all of this is only relevant if one looks at the popular indexes and averages that are driven by big caps, or let us better say, are largely driven by the “nifty five”, or the “nifty ten” if one wants to be generous. Thus SPX and DJIA are not far off their 2015 highs. Things look quite a bit different looking at broader indexes and small cap stocks. Below is a 2-hour chart of the broad NYSE Composite Index (NYA) since its peak in May– originally a good friend sent us a version of this chart with a similar annotation, referring to it as “heresy”.

The NYSE Composite Index, 2-hour chart since its peak in May. The current rebound looks more like a correction than a genuine resumption of the rally. The bounces are weak compared to SPX, DJIA, COMPX and NDX, and there are many overlapping waves (a hallmark of corrective moves) – click to enlarge.

Given the ongoing enthusiasm for big cap stocks with triple digit P/E ratios and current favorable seasonal trends, it seems conceivable that some or maybe even all of the big cap indexes will make new highs that once again won’t be confirmed by the broader list of stocks.

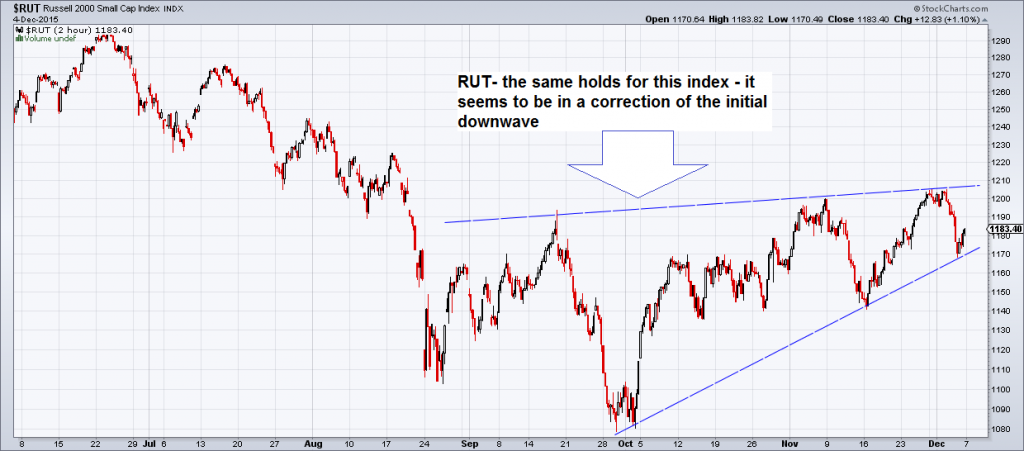

The Russell 2000 Index (RUT) offers an analogous picture:

Russell 200 Index (RUT) – this wedge looks bearish as well at the moment – click to enlarge.

Along similar lines, the Dow Theory sell signal that was triggered in August this year – after many months of diverging prices – remains in force (the sell signal occurred when both the Industrial and Transportation Average broke below their previous intermediate terms lows, thereby “confirming” the trend).

Leave A Comment