The Vanguard 500 Index Fund (VOO) is an index exchange trade fund. The fund is passively managed and is designed to track the investment performance of the Standard & Poor 500 market (S&P 500). The S&P 500 market represents the United States’ largest-capitalization stocks. The respective holdings of VOO are weighted proportionally to the index and adjustments are made accordingly with changes in market.

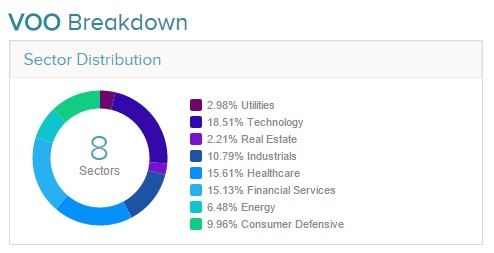

The fund offers four classes of shares; Investor Shares, Admiral Shares, Signal Shares, and Exchange Traded Fund (ETF) Shares. The total asset value of the fund is $38.19 billion. The top five holdings in the fund, in order, are Apple (3.25% of portfolio), Microsoft (2.47% of portfolio), Exxon Mobil (1.81% of portfolio), General Electric (1.64% of portfolio), and Jonson & Johnson (1.58% of portfolio). Overall the ETF has a large concentration of its holdings in technology (18.51%), healthcare (15.61%), and financial services (15.12%) out of the eight sectors that make up the fund.

The average annual return of the fund, measured over the past 15% years, is 10.87%. The fund currently has a dividend yield of 2.31% and pays dividends on a quarterly basis. The turnover ratio for the fund is on the low side at 3% compared to similar ETFs. The ratio measures the percentage of holdings that have been replaced. Additionally VOO has an expense ratio of 0.05% which is also categorically low for most ETFs. Since 2011 the fund’s price as increase 179.22% following the growth of the S&P 500. Currently the stock sits close to its 52 week low ($165.96) at $169.99.VOO has been a highly regarded index fund since its inception in 2011 due to the low expense ratio associated with holding the index. With the low fees, investors can secure a larger average return and participate in the stock market without the risk of owning individual companies.

Leave A Comment