“Compound interest is the eighth wonder of the world.” – Albert Einstein

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.” – Warren Buffett

Compound interest is an extraordinarily powerful financial tool, and reinvesting the cash flows received from investments has historically been the single most reliable way of building wealth over the long term.

For many people, understanding the power of compound interest is the very heart of financial literacy. Compound interest is the reason why people are urged to begin investing for retirement in their 20s and 30s, because having an extra decade or two for interest earnings on interest earnings to work their magic creates a wealth building machine, and far larger savings than would be amassed by someone starting in their 40s or 50s.

However, compound interest is not a constant – it is not always of equal power and it is not always available. The near zero percent interest rates of the decade since the financial crisis of 2008 essentially wiped out the historical norm of individual investors being able to create wealth by simply reinvesting their interest payments again and again over the years.

The times have been changing recently, however, and the Federal Reserve is currently rapidly increasing interest rates. As explored in this analysis, if the Fed carries through with its planned interest rate increases through the year 2020 and then keeps rates at that new level – it will be sufficient to cause the return of a wealth creation “miracle” for every saver and investor in the nation.

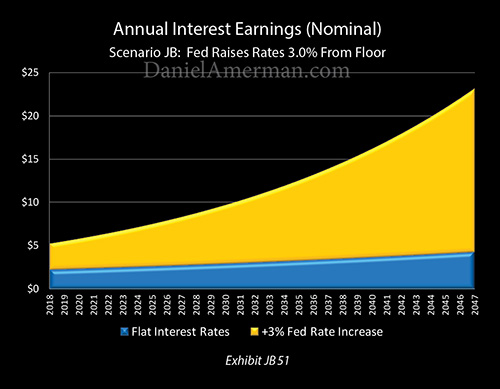

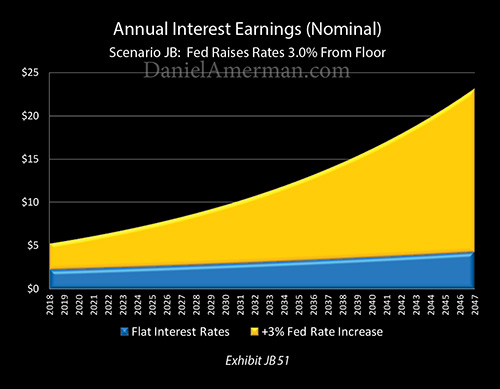

The graph above represents interest earnings for a $100 investment over 30 years. The blue area is where we were with bottomed out interest rates over most of the last ten years. The gold area shows the explosion in wealth for the average saver that will return if the Fed carries through with raising rates and keeps them there.

The sharp upward tilt in the top of the gold area as it pulls away from the blue area with increasing speed – is the return of what Einstein and Buffet were talking about. It is the near miraculous power of compound interest.

However, the future is not like the past. The United States government is over $20 trillion in debt, and it cannot pay the interest on that debt without borrowing the money. The higher that rates go – the higher the deficits go and the higher the debt goes, as the nation as a whole experiences the flip side of compound interest.

As we will explore, there is fundamental conflict of interest between our personal ability to build wealth and the size of the national debt. This conflict did not exist at lower debt levels, but it exists now, and it could be one of the single most important determinants of our personal future financial security and standard of living.

Because the level of interest rates is important for all of the major investment categories, this means that the conflict explored herein could also be a key determinant of the future paths of stock prices, real estate prices and precious metals prices. There are further implications when it comes to financial planning and the allocations between different asset categories.

This analysis is part of a series of related analyses, an overview of the rest of the series is linked here.

The Two Sides Of Compound Interest, Years 1-10

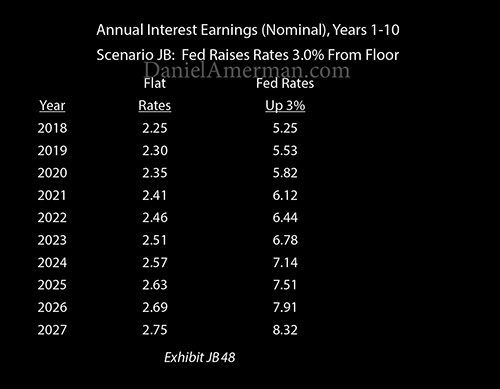

In this exploration, we will isolate the impact of rising interest rates on both average savers and on the federal government. We will assume that an investor is making very safe investments in a mixture of short, medium and long term instruments that produce an average yield that is equal to the average interest rate paid on the federal debt. As covered in the Part 1 analysis linked here, that is about 2.25%.

As described in more detail in the Part 1 analysis, the Federal Reserve is currently discussing interest rates by a total of 3% from their floor. This number is not fixed, and it does bounce up and down, but we will assume that savers will be able to invest at a 3% higher rate, meaning they can earn a 5.25% interest rate, and that over time the average interest rate paid on the federal debt will also rise to 5.25%.

Someone who invests $100 at 2.25% earns $2.25 in their first year, as can be seen in the “Flat Rates” column above. This gives them a bigger investment for the second year – $102.25 – and when that is invested at 2.25%, they earn $2.30. That is five cents more than the first year, and represents interest earnings on interest earnings – otherwise known as compound interest.

By the tenth year, the interest earnings on interest earnings are up 50 cents a year, and total interest earnings for that year are up to $2.75.

Now, if the Fed does carry through with raising interest rates by 3% and keeps them up there, then the first year interest earnings on a $100 investment are $5.25, as can be seen in the “Fed Rates Up 3%” column. That is 2.3X greater than the interest earnings at 2.25%.

By the tenth year, the interest on interest earnings with a 3% rate increase is up to $3.07 ($8.32 – $5.25). So, the interest rate is only 2.3X as great, but the compound interest in ten years is worth more than 6X as much as it would be with flat rates ($3.07/$0.50).

Leave A Comment