Top News Headline

Economic News

Random Thought of the Week

Seven years of zero interest rates and this is the best we can do? The Yellen Fed seems to believe that if they just believe that the economy is good, if they hike rates as if it was good, then it will be so. Which just goes to show how bare the cupboard of monetary policy really is. They’ve got nothing and they know it.

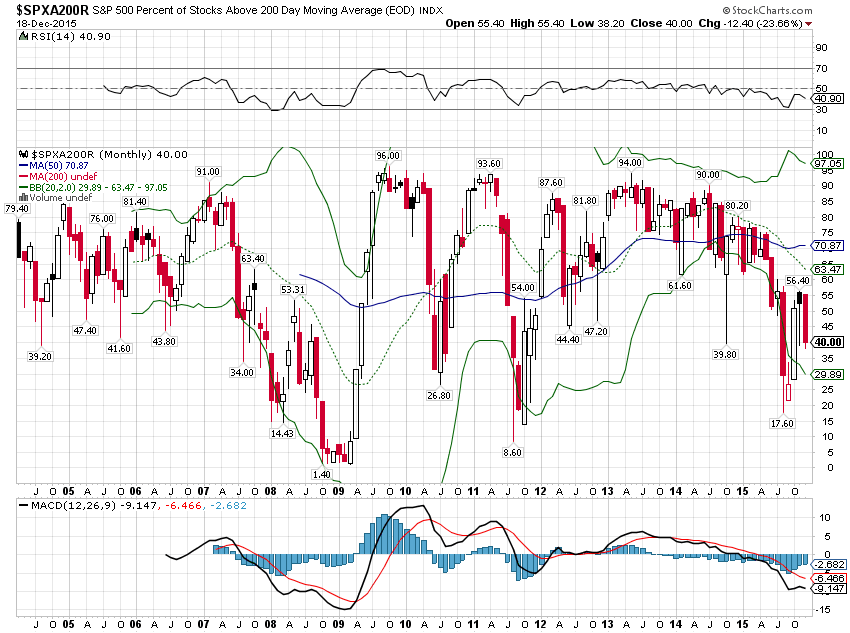

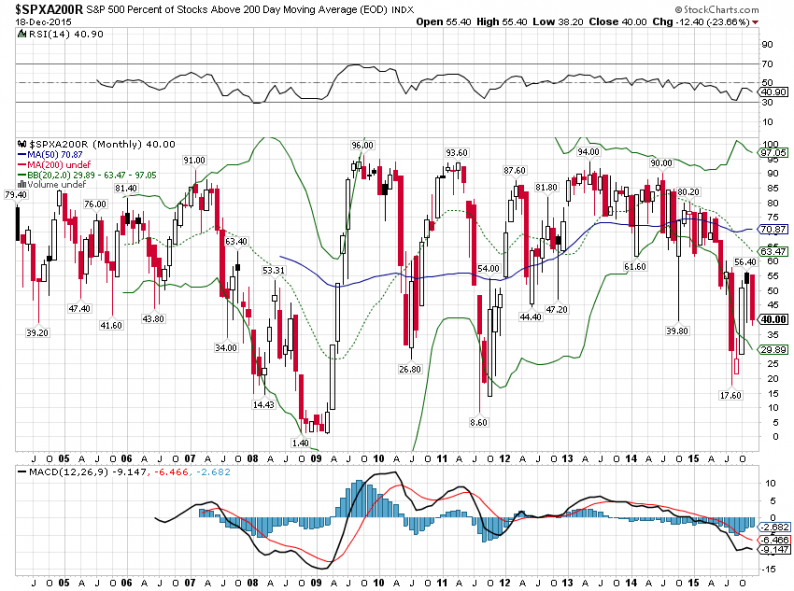

Chart Of The Week

The percentage of stocks in the S&P 500 trading above their 200 day moving average sits today at a paltry 40%. What is really amazing about that number is that it is well above the low set in August in the teens. It is also way above the single digit lows set in late 2008/early 2009. The trend is clearly down and it isn’t just the S&P 500 having trouble. The S&P 100 is at 41% and the NASDAQ is at a gut wrenching 32.5%. These are numbers normally associated with at least a stock market correction and yet today we find ourselves just 6% below the all-time highs. That is a testament to how narrow the market has become with only a few large stocks holding the averages up. I suspect that won’t last much longer.

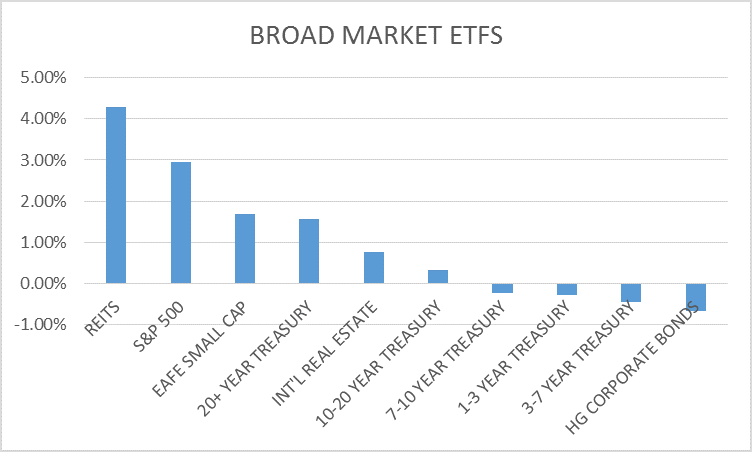

Broad Market – 3-month Returns

Stocks and REITs still lead the pack but are fading fast in favor of high quality bonds.

MOMENTUM ASSET ALLOCATION MODEL

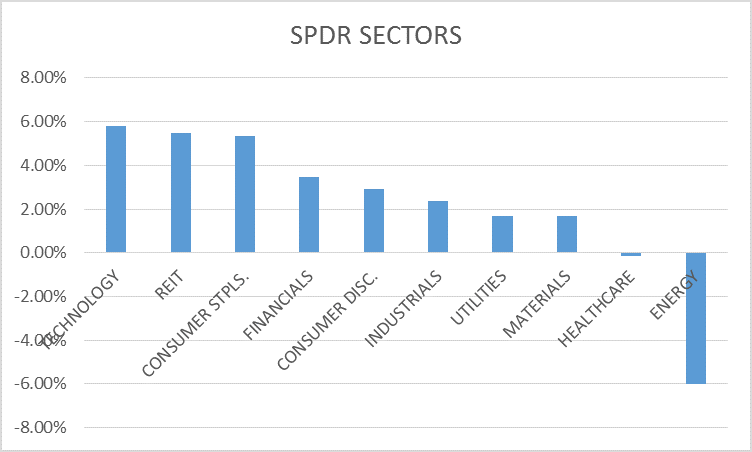

SPDR Sector Returns – 3 Month Returns

Consumer staples and utilities are climbing.

SPDR SECTOR ROTATION MODEL

Country Returns Top 10 – 3 Month Returns

Leave A Comment