Last year’s recap was subtitled “Triumph of the Blowhards”. So far, my plea for the return of rational policy analysis (let alone facts) has failed to occur. But the struggle for sanity must continue.

January. Don’t reason from accounting identities. From More on the Trade Deficit and Economic Growth:

In an EconoFact post from Saturday, Michael Klein and I noted that usually for the US, the trade deficit grows during times of robust economic growth.

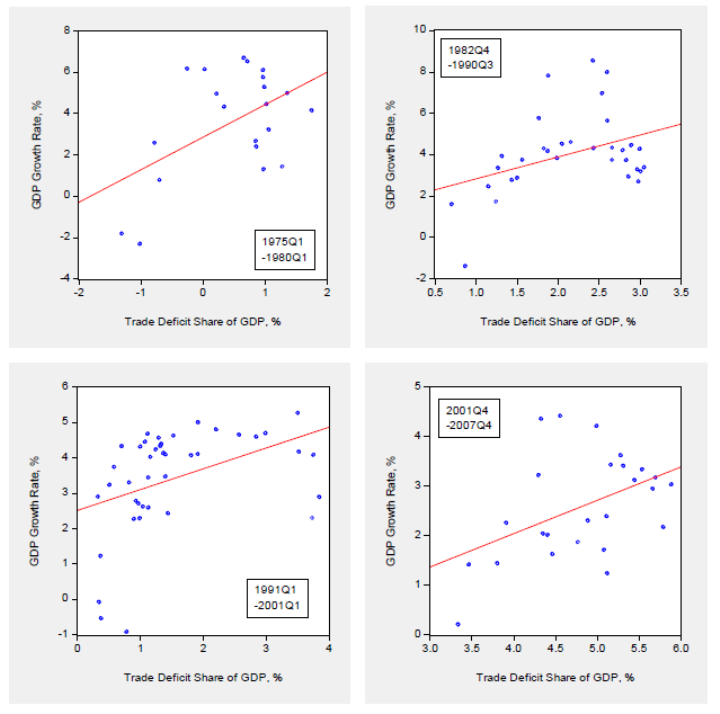

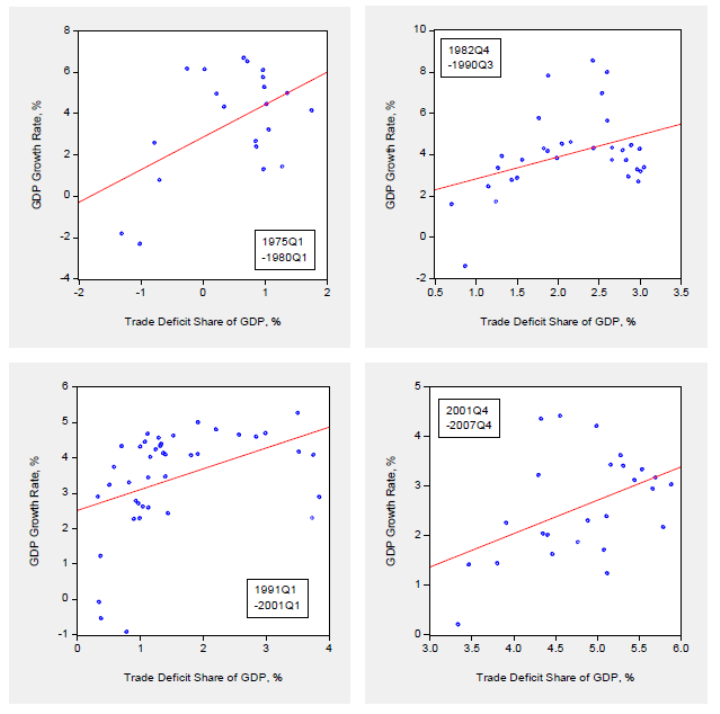

Here I provide an additional way of looking at the relationship between growth and trade deficits — namely scatterplots for the periods from recession trough to peak.

Figure 1: Annualized q/q real GDP growth, % against nominal trade deficit as share of nominal GDP, % for recession trough-to-peak samples. Source: GDP 2016Q3 3rd release, NBER, and author’s calculations.

Notice the clear correlation — as growth accelerates, trade deficits widen.

To understand how thinking in accounting terms can lead to misleading inferences, consider the statement in a Washington Post opinion piece, Peter Navarro and Wilbur Ross wrote:

Net exports are currently running at a negative $500 billion annually, a direct subtraction from growth.

While this is true in terms of accounting, it’s a misleading statement. Consider a firm with revenues of $3 million, and labor and materials costs of $1 million, and hence profits are $2 million. The $1 million in costs are a direct subtraction from $3 million in revenues, but if no labor and materials were purchased and costs $0 million, profits would not be $3 million, but zero.

February. The President feels unappreciated because he doesn’t credit for something that happens almost all the time. From The Media Fails to Report the Sun Rose Today:

President Trump is upset that the media missed this economic event:

“The media has not reported that the National Debt in my first month went down by $12 billion vs a $200 billion increase in Obama first mo”

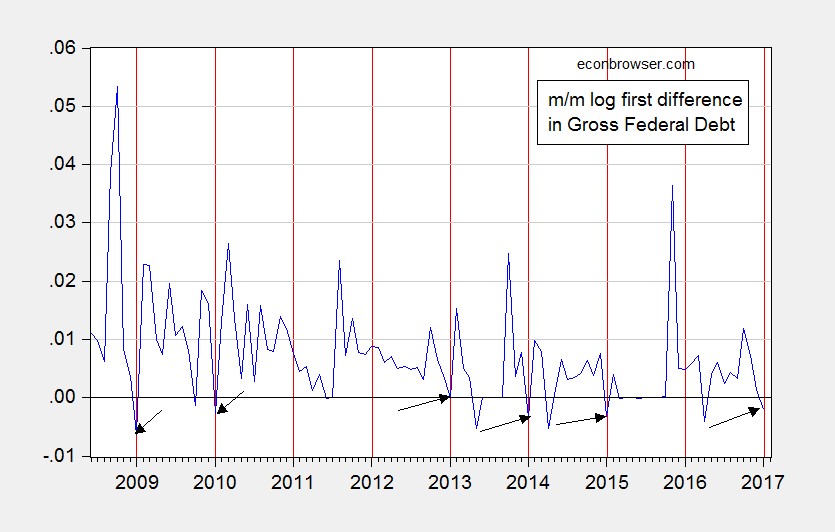

I do not have the stats for Inauguration + 1 month data, but here is end-of-month data through January 2017 for total Federal debt.

Figure 1: Log first difference of monthly total Federal debt (blue), and red lines at January. Arrows at non-positive January entries.

Source: Dallas Fed, and author’s calculations.

Notice that a reduction in debt in January happens more often than not. A regression of this series on a constant and a January dummy over the period 1947M01-2017M01 yields a January coefficient of -0.0036, t-stat of 5.6 (HAC robust standard errors). In words, gross Federal debt drops on average 4.3% (annualized) in January relative to average growth. . . .

March. Forecasting critiques from the least qualified. From Nowcasting with OMB Director Mick Mulvaney:

Since Mr. Mulvaney has been criticizing the numbers produced by the BLS [1], and scoring by CBO [2], I thought it of interest to see Mr. Mulvaney’s record on predictions. To make things easy on Mr. Mulvaney, I thought it would be more fair to evaluate his “nowcasting” abilities.

In July 2016, Mr. Mulvaney gave a speech to the John Birch Society in which he observed:

the Fed’s actions have “effectively devalued the dollar” and harmed economic growth.

It is difficult to assess the economic growth assessment without a counterfactual. However, we can easily observe what has happened to the dollar, as of July 2016, when Mr. Mulvaney provided his nowcast. . . .

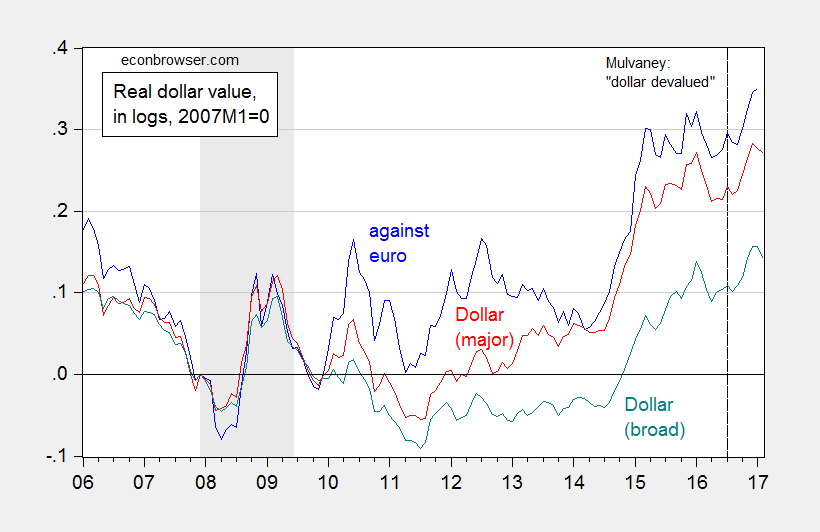

[H]ere is the picture in inflation adjusted (“real”) terms:

Figure 2: Log real EUR/USD exchange rate (blue), value of USD against basket of major currencies (red), and against broad basket of currencies (teal), all normalized to 2007M12=0 (up is stronger dollar). Adjustment using CPI’s. NBER defined recession dates shaded gray. Dashed line at time of Mulvaney’s statement on dollar devalued. Source: Federal Reserve Board via FRED, NBER, and author’s calculations.

Note that at the time of Mr. Mulvaney’s “dollar devalued” statement, the dollar was actually fairly strong, as compared against the previous decade. So, if Mr. Mulvaney is not even aware of how the dollar fares at a given instant, in a world of readily available data, how are we to take his assessments of data validity (e.g., from BLS), or scoring (from CBO)?

On a separate note, is [2] a Freudian slip of some sort on the part of Mr. Mulvaney?

“I don’t believe the facts are correct”

You can’t make up this stuff.

April. Take ALEC predictions, invert them, and you have actual economic performance. From State Employment Trends: Some Selected States and ALEC Rankings :

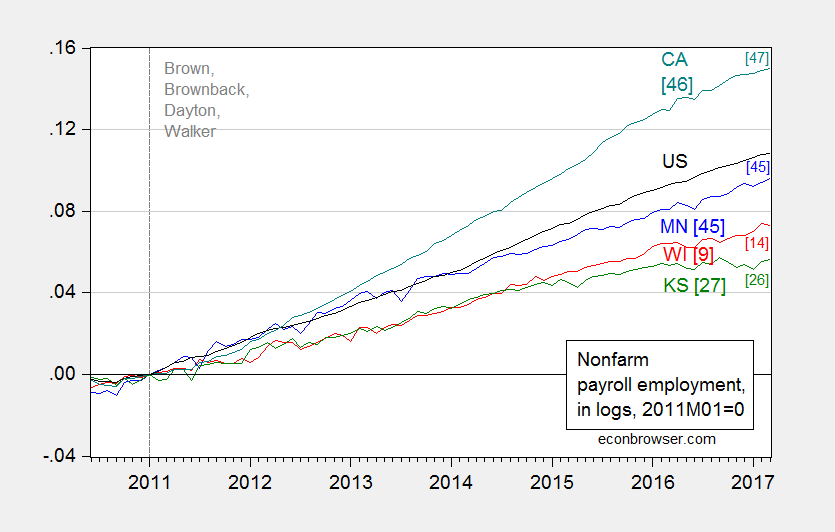

Since 2011 — when Scott Walker and Sam Brownback came into power — California has powered far ahead of Wisconsin and Kansas. The newly released Rich States, Poor States, 2017 allows us to look at how four states, both low and high ranked by Arthur Laffer et al., fared, employmentwise.

Figure 1: Log nonfarm payroll employment for Wisconsin (red), Minnesota (blue), California (teal), Kansas (green) and the US (black), all seasonally adjusted, 2011M01=0. ALEC-Laffer State Economic Outlook rankings for 2016 and 2017. Vertical dashed line at beginning of terms for indicated governors.

Source: BLS, Rich States, Poor States and author’s calculations.

Wisconsin was ranked 9th in RSPS 2016, and had what at best was lackluster employment growth over the subsequent year. California has been consistently ranked very low by ALEC, and yet has outperformed.

For formal statistical analyses relating ALEC rankings to economic outcomes, see this post.

May. One instance of “alternative statistics”. From Stephen Moore Is a Liar:

Or a statistical incompetent. Or both.

(I know, in the grand scheme of lying, this is small bore.)

I just heard Stephen Moore of Heritage Foundation saying we had a trillion dollar budget deficit, in a debate on CNN about the Paris Accord (1:42PM CST).

The FY 2017 budget deficit is $603 billion, according to the just released budget (see Table S-1). Add his serial lying to the statistical atrocity that is the this post, and all I can say is Mr. Moore should not be paid as a “CNN economic analyst”.

Update, 7:14 PM Pacific: I’d forgotten this tabulation of errors by Mr. Moore. The man has no shame.

Bonus: Rick Stryker writes that facts don’t matter.

Leave A Comment