A little over a year ago, we presented a “Yellow” asset, which was “the best performer of the past year.” It wasn’t gold: it was yellow cab medallions.

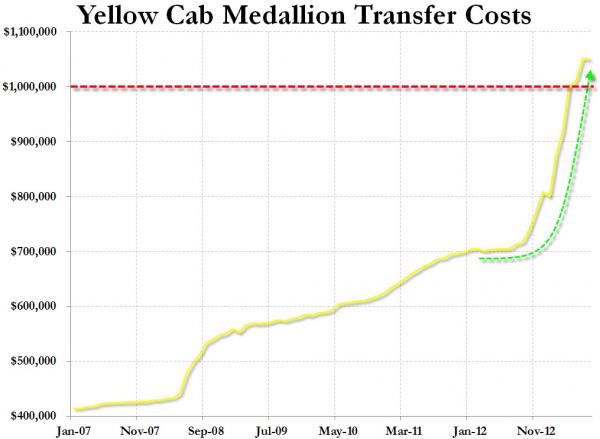

As we wrote then, “the best returning asset class traded in the NY Metro area is yellow but doesn’t change hands on Wall Street…. over the last 12 months New York City taxi medallions have risen 49% in price, besting the relatively humdrum returns of the S&P 500 (up 21%), the NASDAQ (22%) and the Dow (18%). Medallions – essentially the right to operate a for-hail taxi in New York City – now trade for as much as $1.3 million, an all-time record.”

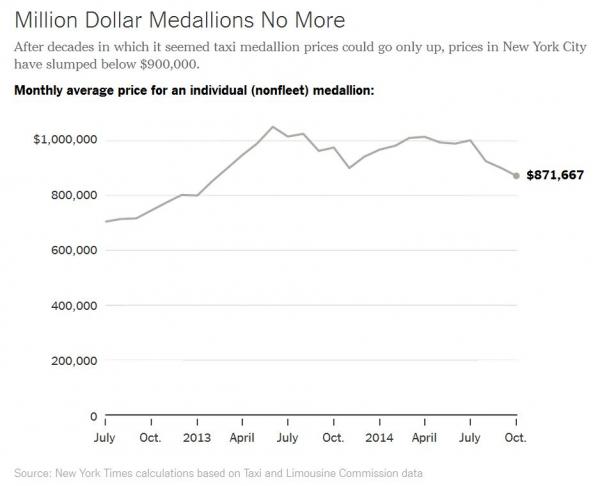

In retrospect it was also the perfect time to cash out on the “yellow” euphoria. According to the NYT, “the average price of an individual New York City taxi medallion fell to $872,000 in October, down 17 percent from a peak reached in the spring of 2013, according to an analysis of sales data. Previous figures published by the city’s Taxi and Limousine Commission — showing flat prices — appear to have been incorrect, and the commission removed them from its website after an inquiry from The New York Times.”

Like everything else, when it comes to price discovery of a depreciating asset, it was not easy to extract that “non-seasonally adjusted” real data:

The turmoil in the medallion market has been obscured in part because publicly disclosed data about taxi medallion prices can be misleading. And the turmoil suggests that the taxi business, which has undergone little change over many decades, is now in the midst of a revolution.

The trouble in New York’s market was also partly obscured by a flaw in the average price reports that were published monthly by the city’s taxi commission until September. Those reports erroneously said average prices for individual medallions had stayed largely the same since setting a record of $1.05 million in June 2013.

In fact, individual medallions have traded below $1 million for most of the last year. But the commission excludes from its statistics any transaction at a price more than $10,000 below the previous month’s reported average.

Leave A Comment