On Monday, a Morgan Stanley report that Amazon was contemplating “disrupting” the Healthcare Distribution sector slammed stocks in the industry, sending the sector sharply lower. Fast forward two days, when Amazon’s disruption appears to have started earlier than even MS anticipated, after a CNBC report that AWS CEO Andy Jassy is planning to announce that Amazon is teaming up with Cerner, one of the world’s largest health technology companies, to help health-care providers better use their data to make health predictions about patient populations.

Yet while Amazon is pursuing aggressive market share theft in the healthcare sector, in retail it is expected to have a more amicable approach, and according to a note by Citi, shortly after its acquisition of upscale grocery chain Whole Foods, the next corporate move by the world’s richest man will be to buy a prominent retailer. The question is which.

As Citi’s Paul Lejuez explains, when AMZN bought WFM in June 2017, it led many to believe that AMZN might have aspirations to establish more of a bricks and mortar presence in the US. Citi also argues that while “grocery is different” (and AMZN may just stop there), Amazon may next target a retailer. It also make the following explicit caveat:

To be very clear, we are not asserting that AMZN will buy any of the names we suggest in the foreseeable future. We have no insight into any AMZN M&A activity or deal flow. We are simply performing an exercise where we consider the question “If AMZN were to buy something in our universe, who could make sense?”

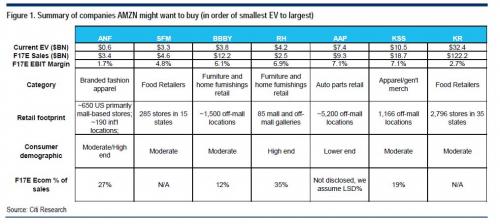

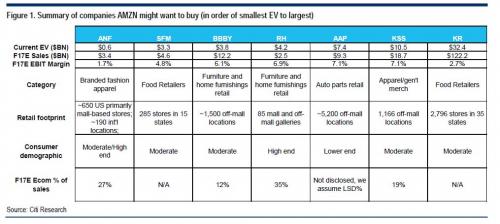

Below, we show who Citi believes may be the best candidates for acquisition by Amazon, and summarize some key components of each of the companies that Citi suggests AMZN may eventually buy.

Why ANF?: (1) EV of only $620MM for 2 brands (A&F/Hollister); combined sales of $3.4BN, (2) own college like campus in Columbus, OH, (3) instant infrastructure to design, source and merchandise apparel on a global basis, (4) young customer base, (5) can use flagships (in amazing locations) to sell proprietary AMZN product.

With ANF, AMZN would acquire a very impressive headquarters in Columbus, OH, which is similar to a college campus. It has a strong culture and has a young workforce that could be leveraged across the AMZN organization.

As far as AMZN’s apparel aspirations, ANF offers an instant infrastructure to design, source and merchandise apparel on a global basis. ANF is vertical, so the brands would become AMZN’s proprietary brands to sell on its own website. And don’t forget they not only have a teen and young adult customer, they also have the A&F kids brand (abercrombie), which could have appeal to the mom shopping for kids clothes on Amazon’s website.

For less than $1BN, AMZN gets three apparel brands they would own (A&F, Hollister, abercrombiekids), a seasoned design/sourcing organization, ~850 stores (including instant access to some of the most desirable locations in the world), and a campus like headquarters they can use (with space to build on further). Oh, and we estimate ANF generates in the range of$50-100M of FCF annually (and imagine how much more productive/profitable those flagship stores could be if they were selling AMZN product). At that small price tag, there wouldn’t be much to lose.

if you’re AMZN, might it be more of an asset to suddenly have control over these flagship stores that are in some amazing locations. Just look at this list:

- NYC (34,000 sq ft on 5th Ave and 56th St)

- London (24,000 sq ft on Savile Row)

- Tokyo (30,000 sq ft on 11 floors in the Ginza shopping district)

- Paris (28,000 sq ft on the Champs-Elysees)

- Milan (20,000 sq ft) – Corso Matteotti

- Shanghai (25,000 sq ft) – Nanjing West Road

- Singapore (20,000 sq ft) – Orchard Road

Leave A Comment