Most of today’s stock speculators don’t remember the bond vigilantes and wouldn’t even recognize one in the flesh. They were just too scary to have been a character on Sesame Street.

But last night some strange riders were spotted galloping eastward from China and Japan. While their visage may be somewhat foggy to the uninitiated, the boys and girls on Wall Street are about to discover that it’s not exactly Big Bird swooping onto their playground.

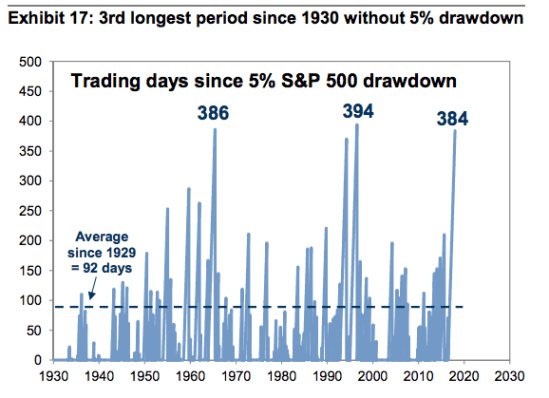

And at precisely the worst time. After all, the 150 Dow point melt-up each day since the turn of the year was fueled by pure speculative momentum. As Heisenberg noted this AM, the S&P 500 has posted one of the longest stretches without a 5% drawdown in recorded history.

Likewise, the weekly RSI for the S&P 500 is now the most overbought since 1959. That is to say, since the days when the great team of President Eisenhower and Fed Chairman William McChesney Martin saw to it that the Federal budget was balanced and that the Fed’s punch bowl didn’t linger down on Wall Street when the revilers got too frisky.

Needless to say, back then there were no bond vigilantes, either, because they weren’t needed. UST’s got priced in the bond pits by investors and savers who didn’t cotton to either inflation or fiscal profligacy. And after the Treasury-Fed Accord of 1951, they would have been just plain horrified by any attempt from the Eccles Building to tamper with UST bond prices or the yield curve.

That’s another way to say that the bond market was healthy, stable and efficient because it was driven by real money investors deploying private savings from income and production, not fiat credits issued by the Fed’s printing presses in the manner of QE.

As it happened, real money savers were destroyed by Arthur Burns and William Miller during the 1970s. That’s because this two Fed chairman —one cowardly and the other clueless—-bent to White House based political bullying and Keynesian economic advice, which was approximately the same thing.

So the bond vigilantes emerged on the free market because real money savers were not ab0ut to see double-digit inflation devour their principal. Indeed, so ferocious were they in demanding that the present value of their coupon and maturity redemption remain money good that they relentlessly dumped the bond until its soaring yield promised to make them whole.

To his great credit, the Mighty Paul Volcker fully understood that his jobs was not to break the bond market or crush the vigilantes but to break the back of commodity and labor inflation that had been unleashed by Burns/Miller. So he did not flinch—even when the 10-year note reached the incredible yield of 15.8% in September 1981.

At length, the CPI plunged in response to the Volcker medicine –and far faster than expected—from nearly a 11% Y/Y rate in the summer of 1981 to a range of 2-4% by late 1983 and thereafter. So the bond vigilantes retreated, as shown in the chart below.

But they were not done. That’s because what Volcker was accomplishing on the inflation front was trashed on the fiscal side when the Reagan supply-side tax cut of 1981 became the occasion for a partisan bidding war on Capitol Hill which literally monkey-hammered the Federal revenue base. Your editor was on hand for the carnage and lost his supply-side virginity in the melee.

To this day, the Reagan hagiographers and Republican revisionist have no clue about what really happened, but here it is in living color in the chart below. The only saving grace is that unlike the asinine front-loaded tax bill enacted by the GOP on Christmas Eve, the 1981 Act was back-loaded, thereby giving time for cooler heads to prevail and for some of the 6.2% of GDP revenue loss (when fully effective) to be recouped.

Leave A Comment