Two points from the 2018Q2 2nd release: GDO is smoother, and a breakout has not yet appeared.

First, consider real GDP and real GDO (average of GDP and GDI) growth, q/q SAAR.

Figure 1: Real GDP growth (blue), and real GDO growth (red), both q/q SAAR, in log terms. Light orange shading denotes Trump administration. Source: BEA, 2018Q2 2nd release, and author’s calculations.

While the quarter-on-quarter GDP growth is high, it’s not unparalleled (see discussion in this post). In addition, GDO, which has shown itself to be a better predictor of revised values of GDP, indicates less rapid growth (see Justin Fox’s article today).

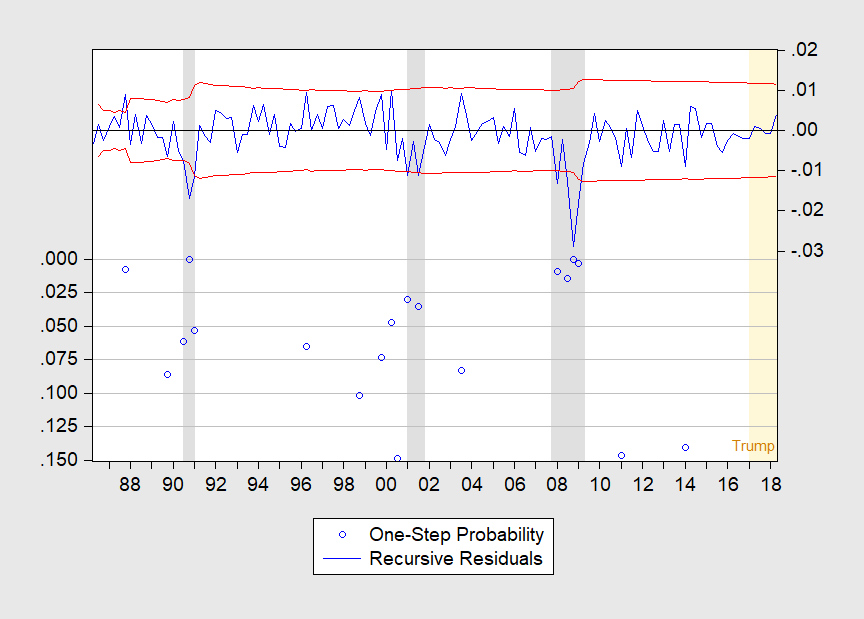

Second, returning to GDP, is there evidence of a breakout in growth? Consider recursive one-step-ahead regression residuals. OLS regressions ?yt = const are estimated recursively (i.e., the sample is progressively augmented after a starting sample) over the Great Moderation period, 1986-2018, and a test applied to see if the residual from the one-step-ahead forecast looks like it comes from a different distribution (the null hypothesis is same distribution).

Figure 2: Recursive one-step-ahead residuals (blue, right scale). P-values (blue circles, left scale). Light orange shading denotes Trump administration. Source: BEA, 2018Q2 2nd release, and author’s calculations.

As indicated in the graph, no break occurs after the Great Recession. These results are robust to another specification (ARIMA(1,1,0)), except a structural break is found in early 2014 (at the 10% msl).

I will say I won’t be surprised to see breaks in the future, particularly with volatility in the net export series likely due to both trade measures and the accounting effects of the TCJA.

Leave A Comment