It’s impossible to tell what drives the short run in anything, so anything we describe and attempt to ascribe moves to comes with a grain of salt. That said, there are clearly some things missing here. I’m not talking about big stuff like overrating the Fed’s predictive abilities and its resolve, ridiculous stock valuations, or anything of the like.

Stocks peaked on Friday, January 26. The following Monday, they hit a small pocket of more intense selling late in the day, the sort of liquidation trend that has become more apparent this week.

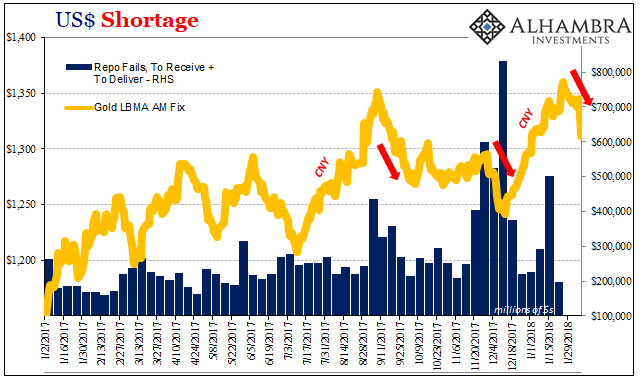

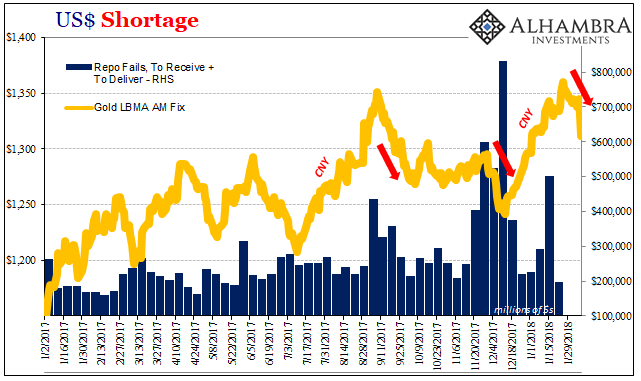

Gold peaked on January 25. It was down about $6 that Friday (26th) and then another $6 the next Monday (29th). When we see these sorts of gold pukes we immediately think of repo. Over the past year, repo and collateral difficulties suggest T-bills. In other words, throughout 2017 there was a clear and intuitive relationship between especially the 4-week bill equivalent yield in discount to the supposed monetary “floor” of the RRP, and repo market collateral problems.

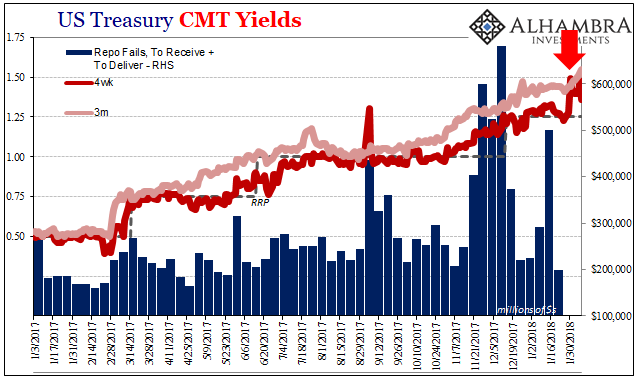

A premium paid for bills is nothing other than a shortage of collateral. Thus, given the setup I describe above, we should have expected to find last week and this week the 4-week bill yield challenging and subverting the RRP, right? No.

Somebody on Tuesday, January 30, was forced to liquidate 4-week bills in serious fashion. The equivalent yield was 1.28% last Monday, and below the “floor” (1.25%) on both Thursday the 25th (1.23%) and Friday the 26th (1.24%). By the end of trading on the 30th, the yield was instead 1.49%, or about where it would have been had the Fed “raised rates” at that policy meeting.

The vote for another rate increase was not held until the 31st, so it is possible that the bond market was anticipating a surprise decision. The fact that the 3-month bill didn’t move much, and that the 4-week bill surpassed it, however, argues that this had nothing to do with Janet Yellen’s last activities.

Some might argue fears over the debt ceiling and the federal government perhaps unable to pass continuing budget resolutions, and maybe that was true, too. But we’ve seen this before, in early September if you recall.

It appears to have been a liquidation of bills, but why? Or perhaps, who?

Now China’s boldest dealmaker, with more than $40 billion of acquisitions spanning six continents, faces growing regulatory scrutiny from Beijing that threatens to spook bond investors and raise HNA’s financing costs when most of the shares pledged to fund its buying spree are declining. If the value of its collateral falls enough, HNA could be forced to sell its holdings to repay debt.

Leave A Comment