While precious metals investors are concerned about the short-term price movements in silver, the real focus should be on this amazing silver market trend. When the silver market data finally came out in the new 2016 World Silver Survey (released May 5th), it really surprised me.And, it takes a lot to surprise me.

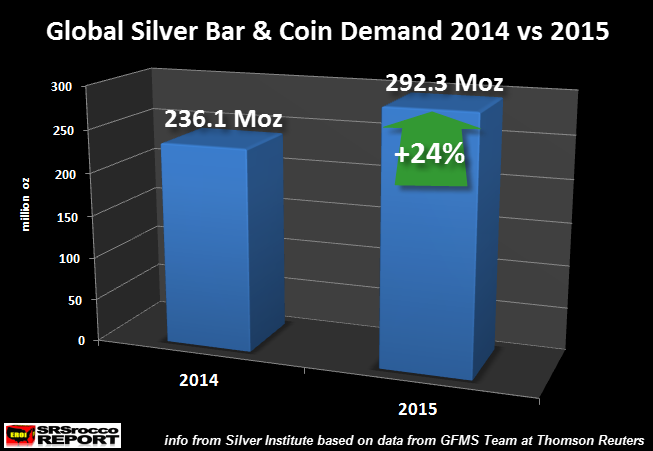

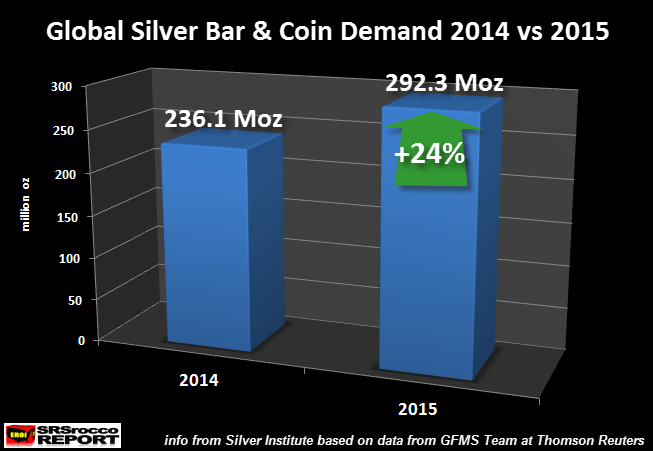

Not only did physical Silver Bar & Coin demand hit a new record in 2015, it did so in a huge way. Physical Silver Bar & Coin demand jumped 24% in 2015 versus the prior year reaching a record 292.3 million oz (Moz).Part of the reason for the higher record was the addition of “Private Bars & Rounds” to the statistics.

I had mentioned in prior articles that I had an email exchange with the GFMS Team at Thomson Reuters about the Private Bars & Rounds figure.The GFMS Team stated that they were working on including this amount, but I thought it would be in the next few years.However, they updated all their past Silver Bar & Coin demand to include Private Bars & Rounds in the 2016 World Silver Survey.

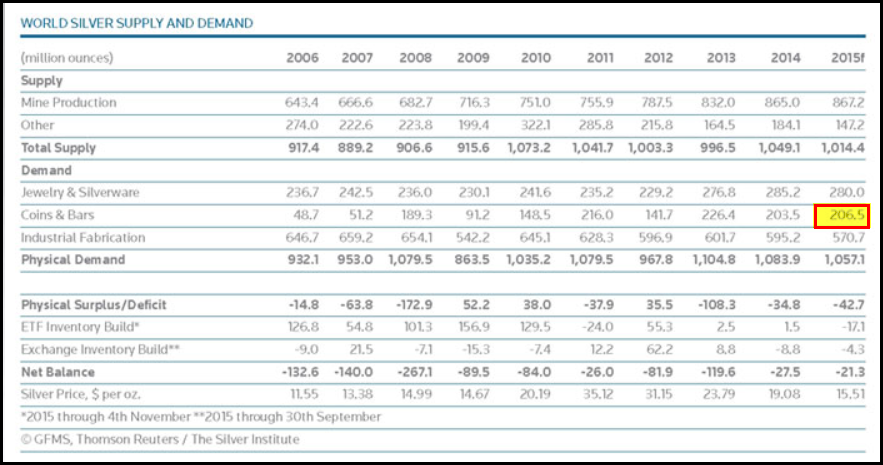

For example, the GFMS Team revised North American Silver Bar demand in 2014 from 10.8 Moz to 42.2 Moz, due the addition of private bars & rounds. The revision was even higher in 2015 as Official Silver coin sales were in severe shortage from July to October.When the GFMS Team first put out their 2015 Silver Interim Report in November 2015, they had estimated total Silver Bar & Coin demand to be 206 Moz:

Thus, the GFMS Team revised Silver Bar & Coin demand for 2015 by an additional whopping 86 Moz.Of course, not all of the revision was due to private silver bars and rounds, but I would imagine at least half of it was.

If you would like to get your copy of the 2016 World Silver Survey, you can but it isn’t cheap.Just click on the link and you can order a copy for yourself.While I realize all the data in this report may not be accurate or some might say, “manipulated”, I think it’s the best source in the market.I highly recommend it over Jeff Christian’s CPM Group 2016 Silver Yearbook.

Leave A Comment