Stock charts are useful because they show traders’ emotions.

In simple terms, rising prices reflect optimism. Downtrends show pessimism. But, of course, we can see more than that in charts.

For example, we can see when new buyers are likely to come into the market.

Remember, rising prices indicate optimism. But some traders will always have new money to put to work.

When prices are moving up, they will worry about paying too much for stocks. So they wait for dips.

That’s where the advice to “buy the dips” comes from.

We also know traders define dips in percentage terms. A 5% dip is a pullback. A 10% dip is a correction.

That means we expect to see buyers appear when prices fall 5% or 10%. In the recent sell-off, that’s exactly what happened.

Ready for a Pullback

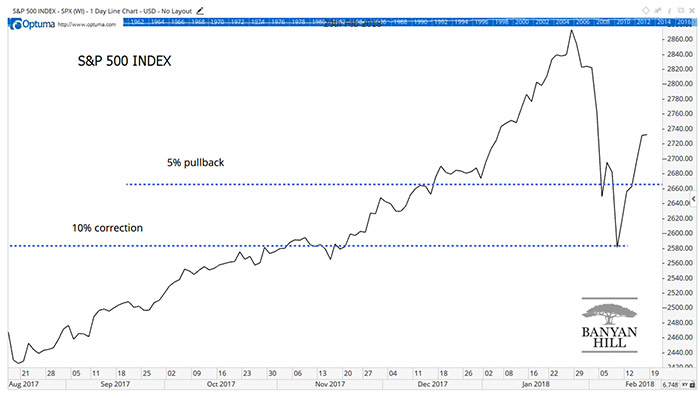

The chart below shows the S&P 500 Index with some important technical levels. Notice that the price bounced off the 5% pullback line and again off of the 10% pullback line.

Prior to the decline, the index had gone more than 400 days without a 5% pullback. That was a record.

Traders were ready for a pullback. And, from the chart, it looks like they were waiting for the pullback to buy.

Skeptics might say this is a coincidence. And it might be. But the fact is, we all knew the uptrend had lasted a very long time.

We also all knew prices couldn’t keep going up forever. Many traders expected a pullback or a correction.

But rising prices don’t stop money from coming into the market.

Putting New Cash Into Stocks

Investment managers at pension funds and other large funds receive cash to invest all of the time. Since they are paid to manage stocks, that cash needs to go into the stock market. They might be able to hide it for a time, but eventually, they need to buy stocks.

So, many managers need a plan to put new money to work. They decide, in advance, which market conditions triggers their buying. Many decide they’ll buy after a 5% pullback or a 10% correction.

Leave A Comment