Look, I’ve got some bad news for you about Bitcoin: if history is any guide, what you saw on Friday morning (when everyone’s favorite “currency” that isn’t actually a currency in any sense of that word crashed below $11,000) is nothing compared to what’s coming.

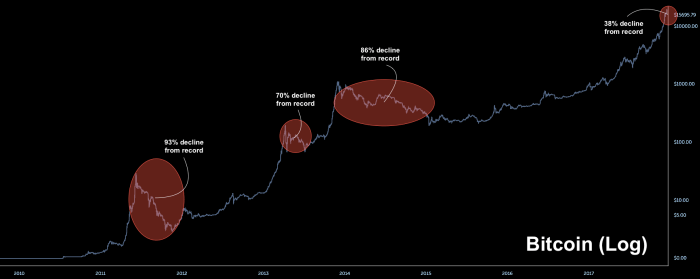

Here’s a chart that shows you the history of Bitcoin crashes:

It is not unusual for Bitcoin to collapse 70% or more after ascending to new record highs.

Who knows, maybe that’s what Mike Novogratz was referring to when, amid Friday’s chaos, the Bitcoin uber bull suggested that in an “extreme” scenario, it could fall to $8,000.

For the time being, it appears the slide has been arrested. On Saturday, Bitcoin has “stabilized” between $14,000 and $15,000.

And make no mistake, this week’s harrowing decline hasn’t deterred all of the bulls. On Friday, Fundstrat Global Advisors’ Thomas Lee recommended investors buy the dip, calling the drawdown a “correction within a long-term bull market.” He also said wallets, or unique IP addresses, will likely rise 50% by mid-2018.

Meanwhile, Goldman is of course moving quickly forward on setting up a cryptocurrency trading desk, a sign that Bitcoin and other digital currencies are on the fast track to mainstream adoption on Wall Street.

Still, skeptics abound among the big banks. “The poor design means that bitcoin is likely a bubble [and] other crypto-currencies are likely to take over,” Citi wrote in a note out this week, adding that “another tripling of bitcoin prices to $60,000 could trigger government action in the more heavily invested countries.”

It’s worth noting that in an environment characterized by low vol. in traditional assets, Goldman’s rivals likely won’t be able to afford to stay on the sidelines if Blankfein and co. do indeed move aggressively into the space.

Leave A Comment