Overview

Emerald Expositions Events (Pending:EEX) filed for its IPO on March 31, 2017. The company expects to raise $295M through the offer of 15.5 million shares at an expected price range of $18 to $20 and to make its debut on Thursday, April 27. If the underwriters price the IPO at the midpoint of that range, Emerald Expositions will have a market capitalization of $1.4 billion and trade at a price/sales multiple of 4.37x.

Lead Underwriters: Barclays Capital, BofA Merrill Lynch, and Goldman Sachs

Underwriters: Citigroup Global Markets, Credit Suisse Securities, Deutsche Bank Securities, RBC Capital Markets, and Robert W. Baird, Inc.

We previewed this deal on our IPO Insights platform.

Business Summary

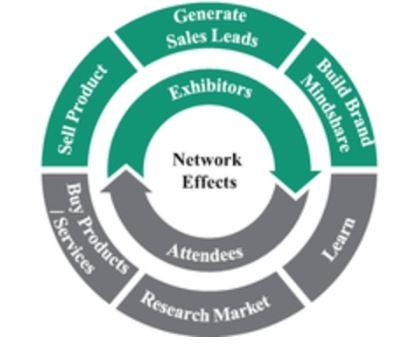

Based in San Juan Capistrano, California, Emerald Expositions Events is the largest operator of business to business trade show events throughout the US. It currently operates more than 50 trade shows, connecting over 500,000 attendees in 2016. It trade shows are used to connect buyers and sellers across a range of markets, including: general merchandise, sports, hospitality and retail design, jewelry, photography, decorated apparel, building, healthcare, and military.

Emerald Expositions, Inc. was originally part of Nielsen Business Media, Inc. and was acquired by PE firm, Onex in 2013. It was rebranded as Emerald Expositions, Inc. and operated as a standalone platform. In 2014, it acquired George Little Management and has completed twelve additional acquisitions to broaden its portfolio since being acquired by Onex.

(S-1/A)

Market

According to IBIS, the US trade Show and Conference Planning market was estimated at $14B in 2016. The overall industry is expected to grow at a CAGR of 5% between 2016 – 2020. Revivied corporate profit is likely to spur demand for trade shows, however online events may take away some growth. The industry is highly sensitive to any changes in economic conditions and a slowdown in the economy could significantly impact business.

Leave A Comment