Happy Halloween. Whether you’ll get a trick or a treat is hard to know in this zombified economy.

Take negative interest rates. When Europe’s central banks pushed rates below zero, large depositors found themselves paying interest instead of receiving it.

But at the same time, some lucky homeowners found their mortgage payments turn into credits.

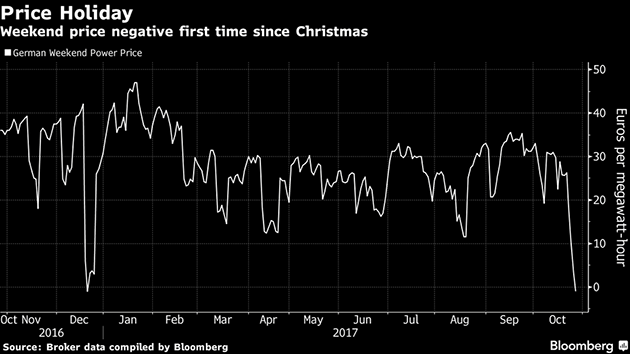

The weirdness continues. Last week, Bloomberg reported that German power producers would likely be paying customers to use electricity this weekend.

How does this possibly make sense?

The answer is in the wind.

Photo: AP

Blown-Away Prices

Normally, utility companies calculate how much a kilowatt-hour of electricity will cost to produce and therefore, how much to charge the customers. That’s pretty easy to do with fossil fuels, but wind production—which Germany depends on heavily—can be volatile due to weather conditions. That means utilities must install extra renewable power capacity to meet demand in suboptimal conditions.

The more power is generated, the cheaper it becomes—so in the occasional great conditions, the ratio goes negative, i.e., there’s so much power generated that instead of making a profit, the utility basically has to pay the customers.

Much of the developing world (plus Puerto Rico) has the opposite problem: expensive electricity, and often not enough of it. But that’s changing as renewable energy costs drop.

Unlike fossil fuels, we can tap solar and wind energy without reducing their supply. That means their cost curve looks more like a new technology than a dwindling commodity.

You’ve heard of Moore’s Law, which says microchip performance doubles every two years. Something similar is happening with renewable energy. Production costs drop as we produce more.

Two months ago, the US Department of Energy projected the unsubsidized cost of wind energy could drop 50% from current levels by 2030.

Leave A Comment