Ok, so we’ve written volumes this year about the extent to which inflows into EM assets have remained remarkably resilient in the face of myriad headwinds, including, but by no means limited to:

Some of EM’s resiliency can be attributed to dollar weakness and to be sure, no one is convinced that DM policy makers are actually prepared to make good on “threats” to meaningfully scale back accommodation.

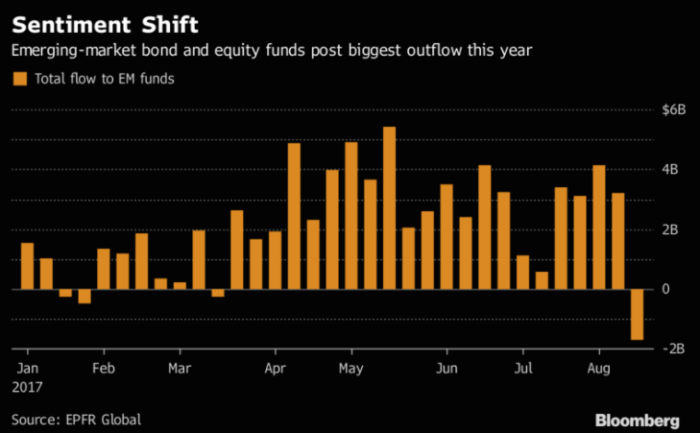

Well, with that as the context, do consider the following chart from Bloomberg which shows that for the first time in 22 weeks, EM assets as a whole experienced a net outflow:

Here’s a bit of color from Citi:

Is this the proverbial tipping point?

Leave A Comment