My Swing Trading Approach

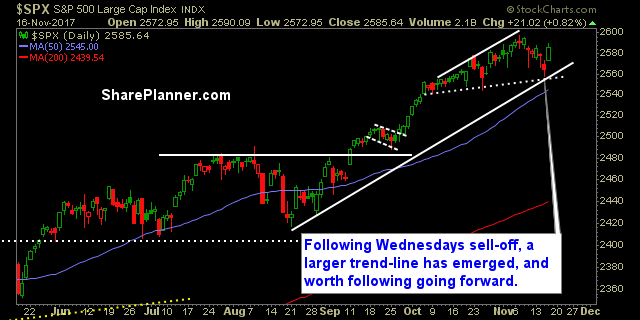

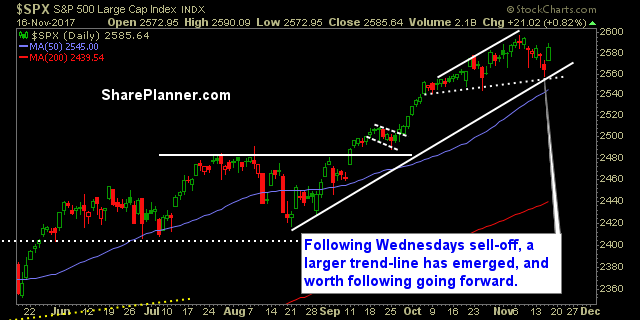

I need to see this market demonstrate some follow through on yesterday’s rally that pushes price action back to or near its all-time highs.

Indicators

VIX – Dropped 10% yesterday down to 11.76. Far off its recent range of sub-10. Broke the 5-day wining streak.

T2108 (% of stocks trading below their 40-day moving average): Massive bounce yesterday, of 11.5% to 46%. Still overall weak, and with the Nasdaq making new all-time highs, it isn’t normal for this few of stocks to be trading above their 40-day moving averages.

Moving averages (SPX): Just like that, it recovers the 5, 10 and 20-day moving averages – all three of which are converging together.

Industries to Watch Today

Consumer Defensive looks like its ready to breakout of its 6 month range in the coming days/weeks. Technology was back to its old ways of leading the market higher. Stay away from Energy – the only sector that didn’t rally at all yesterday. Industrials and Healthcare rallied hard yesterday, but the overall patterns still look bearish.

My Market Sentiment

The bounce was great yesterday for the bulls, and while it “feels” like this market wants to go back to its all-time highs again, I don’t necessarily think it is out of the woods just yet. I’ll continue to be cautious going forward.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment